Support journalism that lights the way through the climate crisis

“If it ain’t broke, don’t fix it.”

For Canadians, and even most Albertans, this clearly applies to the Canada Pension Plan, which is consistently rated one of the best public pension plans in the world. In just over two decades, it’s grown our shared retirement assets from $36 billion to $570 billion, and over the last decade, it’s delivered an average annual return of 10.9 per cent compared to an average of 7.4 per cent for other public pension funds. But Alberta Premier Danielle Smith seems determined to pull her province out of the CPP — and risk breaking it for millions of other Canadians in the process.

The fix is already in, too. Her case for withdrawing Alberta from the national pension plan is built around a long-awaited report her government released and the nearly delusional assumptions it makes. First and foremost, there’s its claim that Alberta is entitled to $334 billion of the CPP’s assets, 53 per cent of the plan’s total funds. This fantastical figure is based on an overly literal reading of 1965’s Canada Pension Plan Agreement Act, one that ignores subsequent changes to the way its funds were invested on behalf of Canadians. As University of Calgary economics professor Trevor Tombe noted, if that same wonky logic was applied to Ontario and British Columbia’s contributions as well as Alberta’s, it would produce a figure equivalent to 128 per cent of the CPP’s funds for just those three provinces. “The interpretation they use in this report is highly problematic,” he said.

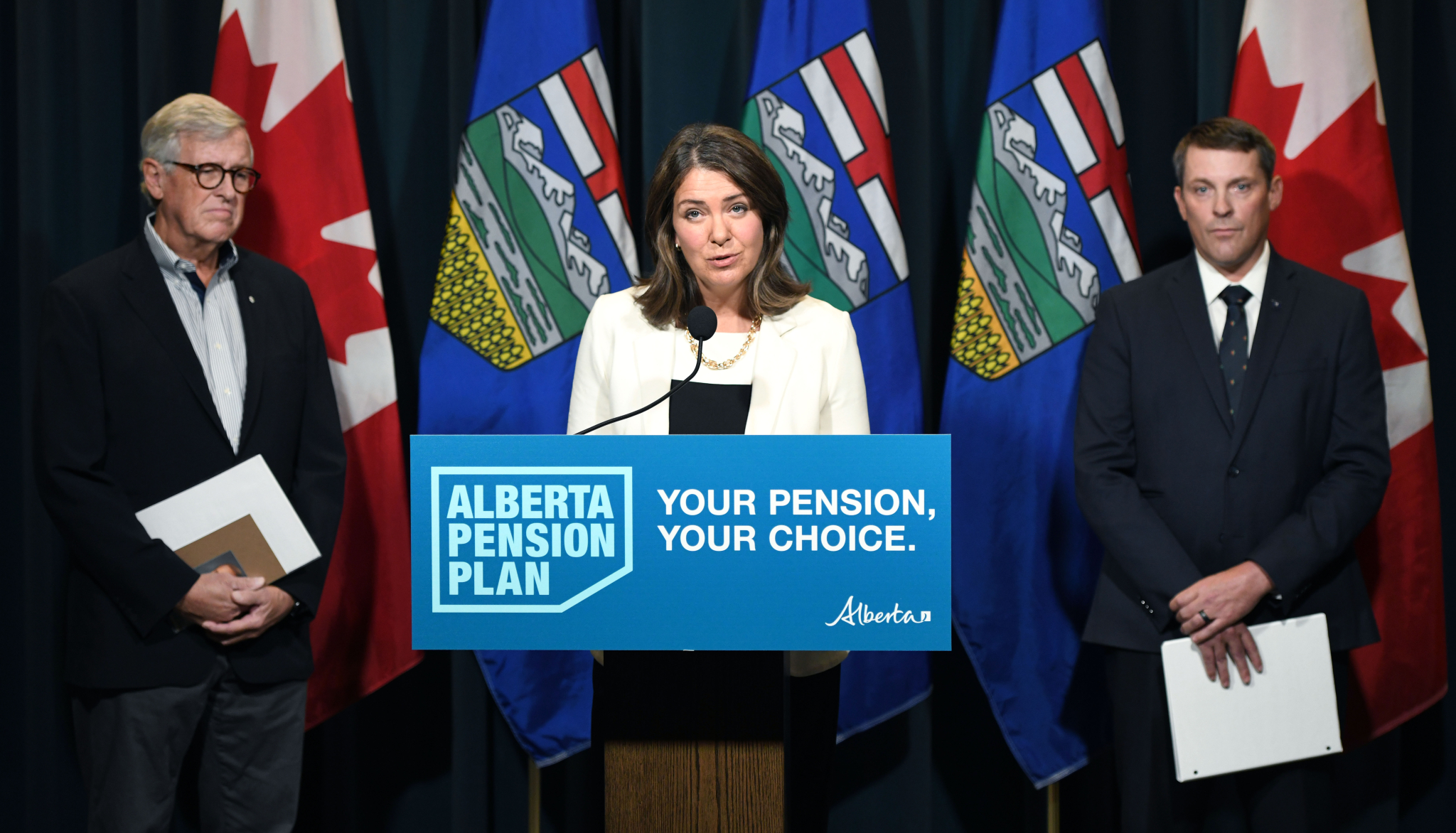

Even so, it allows Smith to pretend Albertans can have their cake and eat it too here: lower annual premiums (an estimated $1,425 a year), higher benefits, and even a one-time cash bonus for retirees as high as $10,000. The public consultation being led by former finance minister Jim Dinning will be framed accordingly, with the government’s thumb visibly on the scale. The sign on the podium in front of Smith at Thursday’s announcement read, “Your pension, your choice,” but her mind is already made up. “I’m persuaded by the numbers,” she said. “I think you can probably tell that.”

As it happens, Tombe released his own report Thursday on the subject, and its numbers are decidedly different. It finds Alberta is entitled to approximately 25 per cent of the projected CPP assets in 2025, or $150 billion. Based on that initial figure, which Michel Leduc, senior managing director at CPP Investments, suggested was far more realistic and reasonable, the combined contribution rate required to keep an Alberta plan stable would be 8.2 per cent, not the 5.9 per cent suggested by the government’s analysis. Albertans, in other words, would have to contribute more to their pensions than Smith is trying to pretend.

And make no mistake: there are meaningful risks associated with Alberta divesting itself from the CPP. Smith isn’t trying to “steal” anyone’s pension, as NDP Leader Rachel Notley claimed on Twitter, but she is placing a potentially risky bet on Alberta’s demographics remaining the same as they’ve been for the last few decades. Those were heavily informed by an oil boom, and specifically an oilsands mine building boom, that hoovered up young workers from across the country. That’s a boom no rational person — including the authors of her own pension plan report — thinks will ever happen again.

Even pro-business advocates can see the downside in this glorified gamble. “There are risks for Alberta in creating its own pension plan,” Canadian Federation of Independent Business CEO Dan Kelly said. “Smaller plans may be challenged in turbulent economic times and even small investment or management mistakes can create significant deficits requiring higher premiums.” Alberta could, theoretically, leave its assets in the hands of the Canada Pension Plan Investment Board, assuming it is even willing to take them on post-separation. But that wouldn’t be in keeping with the “more Alberta, less Ottawa” slogan that’s explicitly part of Smith’s pitch here.

It’s far more likely that she’d prefer to see the assets in the hands of AIMCo, its inferior track record notwithstanding, or a private sector player in Alberta. Indeed, Dinning said as much in his comments to reporters on Thursday. "I think it could be a game-changer for the financial sector in this province to have that kind of weight in international investment markets both locally, nationally and internationally," he said. Sure, the government’s report suggests this approach could cost Alberta taxpayers as much as a billion dollars, but can you really put a price tag on getting one over on the federal government?

Ironically, this idea could end up being a lifeline for the Trudeau Liberals. After all, under the proposed terms and figures presented by Smith’s government, Canadians in the other non-Quebec provinces would need to increase their contribution rates in order to maintain their pension payouts. Trudeau could easily portray himself as the defender of the Canada Pension Plan and force CPC Leader Pierre Poilievre to choose between the pet project of a conservative premier of Alberta and the best interests of Canadians.

Oh, and if Smith wants to use the idea of withdrawing from the CPP as leverage against the federal government’s climate policies, as conservative insider and UCP economist-of-choice Jack Mintz suggested in a column last week? Well, that would give the Liberals an even stronger hand to play. So, too, would any sign that the UCP plans to use some of Alberta’s repatriated pension assets to prop up its oil and gas industry and shield it from the economic realities of the energy transition.

It’s not clear whether enough Albertans will actually support this silliness in a referendum, which is expected sometime in 2025, according to the government’s own timeline. Previous polls have consistently shown a large majority of Albertans opposed to the idea of a provincial pension plan, with a Leger poll in May putting support at just 21 per cent. But Smith’s artificially inflated estimate of how much Albertans would get out of the arrangement could end up breathing new life into the long-standing push for an Alberta pension plan — and the political fortunes of the political party she loves to hate.

I see three possibilities:

I see three possibilities:

1) This is all an elaborate distraction from something else she wants to do;

2) This is a brazen cash grab - there is no other legal way for her government to get hands on the Alberta share of the CPP, except to withdraw from it. Effectively convincing Albertans to hand over their life savings to allow DS to fund some other pet project (or to give away to O&G industry);

3) This is part of a concerted attempt by outsiders to break up Canada

The last one is a bit of a conspiracy, but the USA is looking at James Bay as their mid-west aquifer runs dry. The more likely one is #1 - I cannot believe that DS or her patrons are so stupid as to believe that Albertans will just hand them a blank cheque. So the question is, what else is going on in Alberta that would warrant such a large smoke screen?

I'd go with a combination of

I'd go with a combination of 1 and 2, but with significant emphasis on 2. The cash grab seems weird and outlandish, yes. But there's a specific outland where talking about grabbing the national pension fund and handing it to private sector cronies so they can make more money is mainstream politics, and the outland in question is the United States of America, which is also where Canadian Conservatives get their politics. And you just know that if she manages to get control over that pension fund, private sector cronies are the ones who will profit. That and the oil patch, just before demand dries up and its stock prices plummet.

And the American right keep talking about privatizing Social Security even though nobody wants it and it's probably political suicide for anyone who actually manages it, and even though they know any given attempt will probably fail. They do this because they figure if they keep the idea alive as something plausible and conventional-wisdomy, someday there will be a crisis they can take advantage of and ram it through, and then grateful Wall Street financial behemoths will reward the ones responsible so hard they can retire from politics to an island of their own.

So it may well be this isn't Smith actually intending to get this done, so it's mostly #1. But just because this is the first floating of the idea doesn't mean it isn't an objective, for her handlers if not for her.

Fawcett: "Smith isn’t trying

Fawcett: "Smith isn’t trying to 'steal' anyone’s pension, as NDP Leader Rachel Notley claimed on Twitter"

Don't be so sure.

Smith's Alberta Pension Plan is not about getting a better deal for Albertans. The UCP want to get hold of Albertans' pension dollars to prop up the O&G industry (as Fawcett suggests further down). Just like AIMCo and the Alberta Heritage Savings Trust Fund (HSTF).

AIMCo (AB's public pension manager) and Alberta's HSTF have sunk over a billion pension dollars into failing O&G companies to keep them afloat:

"Alberta public pension manager loses big in oilpatch investments: analysis" (CP, April 22, 2020)

"Alberta's public pension manager has lost millions after investing in smaller energy companies at a time when the entire sector is in decline.

"AIMCo has invested $1.1 billion FROM PUBLIC SERVICE PENSIONS in junior and intermediate oil & gas firms since 2016.

"Most of those companies lost value well before the COVID-19 crisis and oil supply war... At least one company has gone bankrupt despite the injection of tens of millions of pension dollars.

"'The vast majority of them were in really rough shape before the crisis.'

"Of the $406 million invested under the Alberta Growth Mandate, nearly $270 million — two-thirds — went to the energy sector.

"Of the 32 separate investments made under the NDP provision, five were in real estate, one in agriculture and one in renewable energy. The rest [25] were in oil & gas and all have lost value.

"One, Trident Exploration, went under last year despite a $60-million injection of pension funds. Others have had to renegotiate their debt. Others, such as Pieridae Energy, in which AIMCo has invested $120 million in debt and equity, are high-risk investments.

"Many have large environmental liabilities."

"Alberta will see a provincial pension plan report released today. Here's what to expect" (CBC, Sep 20, 2023)

"… In that 2019 CBC panel, Smith also suggested an Alberta pension plan could have provincially directed investment policies — the sort of political interference with pensions that critics have warned about.

"'If CPP starts bailing out of energy resources, we don't want to be in a position where our money is being used to support solar and wind or other experiments that the CPP — driven politically by a Trudeau government — might want to invest in.'"

As a Québécois, I have no

As a Québécois, I have no opposition to the possibility of a provincial pension plan; Québec made the decision to have its own pension plan in the 1960s. However, trying to run away with over 50 % of the total funds of CPP is a preposterous outrage for the other citizens of the ROC ( Rest of Canada).

Conspiracy or not, I’d like to dwell on the third possibility of Mr Hugh Ferguson when he writes ; «…the USA is looking at James Bay as their mid-west aquifer runs dry. ...» . Elaborate plans have been made on that sujet. Sixty years ago, engineer Thomas Kierans prepared the initial plans for the Grand Canal projet. During the election campaign of 1985, then leader of the of the liberal party of Québec, Robert Bourassa, made a strong pitch for that plan ; it helped him become the Premier. There is plenty of literature on the subject of Grand Canal, but for starters, try reading

https://en.wikipedia.org/wiki/Great_Recycling_and_Northern_Development_C...

and

https://www.theglobeandmail.com/news/national/a-visionarys-epiphany-abou...

From an environmental point of view, the potential for disaster are mindboggling. This is a re-engineering of the major watersheds of the continent. Getting thousands of cubic meters per seconds (cubic M/sec.) of water to go uphill to the vicinity of the city of Amos ( approx. altitude =270 m above sea level) would require massive amount of energy. Québec’s environmental agency, BAPE disagreed firmly with such massive exportation of water. See

Rapport du BAPE générique sur l'eau no 142, 2 volumes, 1 mai 2000. Voir le volume 1, pages 9 et 10. Également disponible en version électronique : http://www.bape.gouv.qc.ca/sections/archives/eau/index.htm

I hope that both the proposed « theft » of the funds of CPP by Danielle Smith and the Grand Canal projet will be shelved

Very interesting comments and

Very interesting comments and links. Thank you!

I note that the Grand Canal map indicates the longest "canal" was proposed for BC, essentially rerouting the Yukon and Columbia rivers to flow south via the Rocky Mountain Trench primarily to California. It was roundly rejected by Western politicians and critics, but BC premier W.A.C. Bennett went ahead with his own plan and, like Quebec, built a hydro power legacy with power export contracts with the US under the Columbia River Treaty.

Environmentally, BC Hydro has done great damage to the province's forests and river valley farmland, the latter being a very scarce resource to begin with in the nation's most mountainous province. Today, hydro is seen as a solid foundation upon which to expand the nation's low and zero emission electricity supply to fight climate change, but the notion of expanding hydro in BC more was hard fought with the current Site C project on the Peace River. That will likely be the last hydro dam ever permitted here, and rightfully so.

The CPP and Equalization

The CPP and Equalization contributions are mainly income-based. If Alberta is unhappy with its level of contributions -- irrespective of CPP and Eq payments to Alberta (the province received $10B more from Eq than it paid in 2020 as the result of the pandemic) than it can lower the incomes of Albertans.

Not gonna happen? So then separate from the country. No stomach for a genuine separation referendum? Then maybe it could wake up and do another analysis on the benefits of confederation concurrent with one on the potential that oil demand will decrease in its export markets as renewables ramp up worldwide.

The Alberta leadership is so subserviant to its dependency on fossil fuels it cannot see their own noses through the pall of smoke from climate-generated forest fires, let alone the dangers of a mono-economy.

Comments