Support strong Canadian climate journalism for 2025

Finance Canada has no plan to keep Canada's international promise to phase out inefficient oil and gas industry subsidies by 2025.

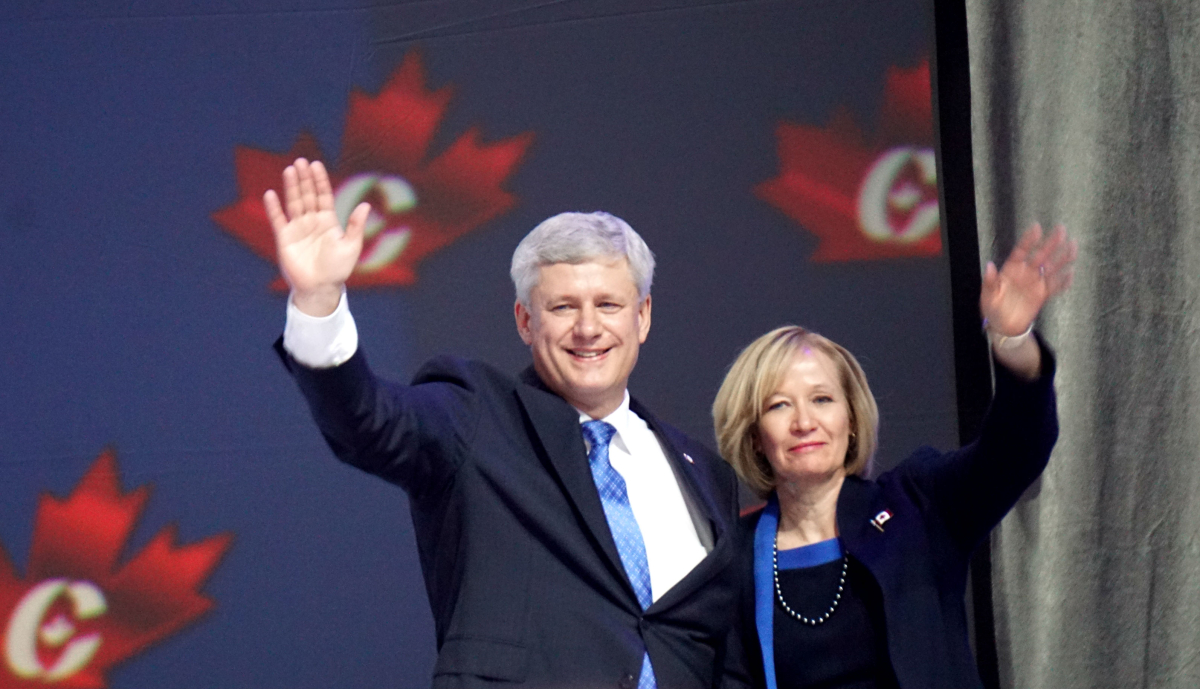

The department has had eight years to come up with a list of actions and timelines to deliver on the commitment made by former prime minister Stephen Harper at the 2009 G20 summit in Pittsburgh. But a new report on fossil fuel subsidies, released Tuesday by Canada's auditor general, Michael Ferguson, revealed that little was done to make good on Harper's promise.

In addition to failing to adequately define the terms of Canada's commitment to phase out fossil fuel subsidies, Finance Canada declined to provide auditors with the internal documents required to complete their analysis.

“Really, they’re unclear as to what remains to be phased out, and they don’t have a plan for how to get there,” an auditor who worked on the report told National Observer.

In a press statement released after the audit however, Finance Minister Bill Morneau appeared to disagree. He said Canada has taken a "significant amount" of action towards reducing inefficient fossil fuel subsidies — more than most G20 countries — and is on track to reach its 2025 targets.

"Most recently, in Budget 2017, the Government committed to modify the tax treatment of exploration expenses for oil and gas producers, and to phase out the tax preference that allows them to reclassify certain development expenses as more favourably treated exploration expenses," he said.

"As a result of these actions, eight fossil fuel subsidies have changed and we will continue to look for more that are potentially relevant to the G20 commitment."

According to a follow-up statement from Finance Canada, those subsidies include a phase-out of the accelerated capital cost allowance for oilsands, and a phase-out of the Atlantic Investment Tax credit for investments in the oil, gas and mining sectors, among others.

No definition of fossil fuel commitment

In 2009, Canada, and 19 other countries, committed to “phase out and rationalize inefficient fossil fuel subsidies while providing targeted support for the poorest.”

Fossil fuels, which include coal, oil and natural gas, are a non-renewable source of energy that produce climate-polluting greenhouse gases when burned.

“This audit is important because while fossil fuels play an important role in Canada’s economy, their consumption is the main source of greenhouse gas emissions,” said Ferguson’s audit report.

“Fossil fuels also have a negative impact on the health of Canadians. Furthermore, inefficient subsidies to the fossil fuel sector encourage wasteful consumption, undermine efforts to address climate change, and discourage investment in clean energy sources.”

The federal government has reaffirmed its commitment to reduce support for the industry every year since then, including at the 2016 G20 summit in China.

But Finance Canada, the department responsible for eliminating tax breaks that advantage the oil and gas industry, failed to produce evidence that it has considered all tax measures, and whether they would be considered “inefficient” fossil fuel subsidies under the G20 commitment.

The department has not, said the auditor, satisfactorily defined the words “inefficient,” “rationalization,” or “support for the poorest” — and neither has Environment and Climate Change Canada.

According to the report, Environment Canada did, however, develop a plan to guide the initial stages of its work; it has not implemented that plan. It also didn't have a solid understanding of which federal non-tax measures qualified as “inefficient” fossil fuel subsidies.

Environment Canada’s role in delivering the G20 commitment includes identifying other, non-tax ways the federal government supports the oil and gas sector. Examples include loans, loan guarantees at favourable rates, or the credit guarantees offered through Export Development Canada, a Crown corporation.

In 2012, the Office of the Auditor General reported that federal funding for fossil fuel sector research and development totalled $508 million between 2007 and 2012, not including all of these non-tax measures.

Violation of “Cabinet confidences”

Upon request however, Environment Canada did produce all the documents required by the audit team.

Finance Canada, on the other hand, refused to provide more than 240 pages of budget briefing notes containing analyses relating to the G20 commitment that were prepared to assist ministers between 2010 and 2016. Those documents, it told the audit team, were “Cabinet confidences” that it could not hand over without compromising ministerial confidentiality.

Auditors also asked Finance Canada for the strategic environmental assessments it conducted on fossil fuel subsidies and considered in its evaluation of the G20 summit promise. A few examples were provided, heavily redacted, again for the purpose of Cabinet confidence.

As a result of lack of access, said the auditor, the audit team couldn’t carry out the full scope of its report.

“At the end of the day, we said we really don’t know if they did or didn’t do the analyses that they should be doing in order to support decision-makers in deciding what to phase out,” the official told National Observer.

Finance Canada also failed to produce similar documents for another federal audit, including an analysis of the $20 minimum threshold for customs duties on parcels imported into Canada by mail or courier.

In a press release, Morneau said the department provided all the documents it could under the rules at the time. He also promised he would work with the auditor general moving forward to assist in finding areas where the government can improve its delivery of service to Canadians.

"We believe that greater openness and transparency in government helps strengthen Canadians' trust in our public institutions," he said.

Asked to respond to allegations that his department had not come up with basic parameters for defining or implementing the G20 promise, his team told National Observer:

"The Department took a broad approach and defined the scope of potential fossil fuel subsidies by consistently identifying all federal tax expenditures that provide preferential treatment that specifically supports the production or consumption of fossil fuels.

"Finance Canada has, on a timely basis and in accordance with its role, consistently and systematically identified federal tax expenditures that support fossil fuels, analyzed them and developed policy options for consideration by the Government."

A new order in council coming

Asked if it was ‘legal’ for Finance Canada to withhold information from auditors, a senior official in the auditor’s office said it was complicated.

Under the Auditor General Act, the Office has a broad right of access to any information it deems necessary to carry out its work.

The documents that the audit team requested however, did not fall within the scope of special orders in council issued by the federal government in 1985 and 2006, that define the type of Cabinet confidential documents federal departments must produce to the Auditor General.

That’s a “policy position” of governments, the counsel told National Observer.

It’s not the first time the auditor general’s office has been in dispute with the government of the right to access information required to do its work, said a broad message from Ferguson on the work completed this year.

With the completion of the new audits, however, the government has agreed to issue a new order-in-council that will ensure Finance Canada must hand over such documents in the future, he added.

“From our perspective, we need to see the analysis that public servants have done to make sure that it is thorough, that full information is provided to decision-makers,” a senior legal official from the auditor's office told National Observer.

“We do not need or want to see recommendations to ministers or advice… but the analysis, options, facts — that type of information is basically fundamental to our work.”

Make a plan moving forward, say auditors

Financial audits account for nearly 50 per cent of the Office of the Auditor General’s workload. For the 2015 to 2016 fiscal year, the Office audited 69 federal financial statements covering more than $1 trillion assets, according to the report.

The auditor said an audit of actions taken to reduce greenhouse gas emissions is currently underway and scheduled to be tabled in the fall. Moving forward, she added, other climate action commitments could be audited as well.

Her team made several recommendations to both Finance Canada and Environment and Climate Change Canada, all of which the departments accepted. Those recommendations included developing more clear definitions of the G20 commitment and how they would ensure that the impacts on the poorest are considered in suggesting measuring to phase out inefficient fossil fuel subsidies.

Recommendations specific to Finance Canada also included the development of an implementation plan with timelines, and a complete analysis of all tax measures that apply to the fossil fuel sector, including benchmark tax measures.

Editor's Note: This story was updated at 11:27 a.m. on Wed. May 17, 2017, to include a new statement from Finance Minister Bill Morneau's office.

Comments