Support strong Canadian climate journalism for 2025

Can technology lower the carbon footprint of Canada's oilsands?

Canada's oilsands throw off considerable greenhouse gas emissions: 70 megatonnes of carbon dioxide equivalent in 2015, the most recent year data is available. That's almost ten per cent of Canada’s entire annual emissions profile.

New technologies may have the potential to change that by slashing per-barrel greenhouse gas emissions from typical oilsands operations by up to 80 per cent, and production costs by up to 40 per cent, according to the Canadian Energy Research Institute (CERI).

“There's a huge incentive for companies to innovate and to try to realize some of these efficiencies and adaptations of technologies,” Dinara Millington, vice-president of research at CERI, a registered charitable organization with strong ties to industry, told National Observer last fall.

The question for environmentalists, however, is not whether it is possible for technology to green the oilsands, but whether doing so would eventually create more harm than good. The thinking goes for some that no matter how 'clean' the oilsands extraction process becomes, the end result is the production of more heat-trapping fossil fuels — which must be phased out this century to help limit catastrophic climate change. To that point, Adam Scott, of Oil Change International, says, "We already have the technologies we need to shift away from fossil fuels to clean energy. Wind and solar are now market-competitive, out-competing the dirtier alternatives and last-century fuels like natural gas, coal and oil. There’s no new technology required to make that transition. It’s just about investment and actually doing it.”

As for 'actually doing it,' Alberta is investing $440 million over seven years in "oil sands innovation to help companies increase production and reduce emissions," the province announced last December. The government committed an additional $465 million to "innovation across sectors" and "industrial energy efficiency," both available to oilsands producers.

But, "this is the wrong way for the government to direct really scarce public revenue," University of Alberta political science professor Laurie Adkin says. Last July, Adkin wrote an open letter to the provincial government calling for a public inquiry into any new public funding of oilsands research. "We should be spending everything we can in growing the renewables sector as fast as we possibly can and not investing in a medium- to-long-term strategy for the oilsands," said Adkin. "Industry is taking a gamble on this. Do the rest of us have to?"

Further muddying the picture is the fact that some of the more advanced oilsands greening technologies — the ones that promise the most dramatic cuts to carbon pollution — appear to be still in the testing stage. Also, a rebound of global oil prices, which are currently depressed from the 2014 highs, would provide a powerful incentive for energy firms to launch new oilsands projects, threatening to wipe out any green gains from technology.

A clear way to melt away?

Many people picture surface mining when they think of the oilsands: massive trucks and barren pits as far as the eye can see. But this is changing. Future expansion will be almost entirely via in-situ, or “steam-assisted gravity drainage” (SAGD). This involves forcing large amounts of steam underground, melting the bitumen and pumping it to the surface. In a recent report, the National Energy Board said oilsands surface mining will stabilize after 2024 at around 1.7 million barrels per day (bpd). But in-situ production will more than double from 1.4 million bpd in 2016 to 2.9 million bpd in 2040.

That has serious implications for Canada's carbon pollution, as in-situ requires consuming large amounts of natural gas to heat water, produce steam, and extract underground bitumen. Many oilsands technologies are aimed at providing alternative methods of pulling bitumen from sand. Companies could change how they generate steam, or use electromagnetic heating or solvents instead. These are the most promising options so far, researchers say.

"You could...melt it away using other energy sources,” says Dan Wicklum, Chief Executive of Canada’s Oil Sands Innovation Alliance, a group of oil sands producers. These technologies show significant promise — in theory. Unfortunately, most can only be applied to new production facilities and can’t be retrofitted onto existing facilities. According to Benjamin Israel, an analyst at the Pembina Institute, "You're not just talking about bringing new productions using those new technologies, but you really want to be able to do some retrofits to capture the emissions reductions at existing facilities. That's the main challenge."

One technology that can be installed on existing oilsands upgraders and refineries is carbon capture and storage (CCS). In this scenario, captured carbon dioxide is used for “enhanced oil recovery.” There are already two CCS projects in Alberta, both near Edmonton: Shell’s Quest Project and Enhance Energy’s Alberta Carbon Trunk Line Project. But the technology is still prohibitively expensive, costing well over $1 billion per project. That works out to what the Parliamentary Budget Officer called an “implicit carbon price” of about $60/tonne. Without more government funding, technological breakthroughs or a much higher price on carbon, future carbon capture and storage projects seem unlikely.

Speeding up commercialization

Environmentalists argue that a discussion of breakthrough technologies in the oilsands misses the bigger picture.

“The oil industry wants us to believe that their challenge is per-barrel emissions, when in fact that’s not the primary objection to [oilsands] development,” said Scott of Oil Change International. “Our primary concern is about the lock-in that happens when you build new projects that are meant to last for decades. The total emissions from those barrels, producing them and burning them, is massive.”

The SAGD technology commonly used today was first patented in 1969 but wasn’t commercialized until 1996 by energy firm Cenovus. Millington of the Canadian Energy Research Institute cited that delay as evidence of a need to greatly accelerate the timeline for widespread deployment of new technologies. “It’s going to be a multi-discipline, multi-organization effort for some of these technologies to get on the commercial scale,” she said.

Replacing steam with solvents

One common scenario describes a process to replace the gas-generated steam that loosens bitumen from underground with fossil fuels themselves such as propane and butane. This option promises to cut costs and emissions, but could potentially come at a high environmental cost if groundwater is compromised. Imperial Oil already combines solvents with steam at a Cold Lake site, cutting emissions by some 25 per cent compared with typical existing SAGD technology.

That is known as co-injection, something Cenovus is also eyeing for its proposed Narrows Lake project near Fort McMurray. Imperial would also use the technology in two new proposed projects — the new Aspen project near Fort McMurray and an expansion of the Cold Lake project, increasing production by a combined 200,000 bpd. A more extreme version of this scenario involves replacing steam entirely by solvents, what’s known in the industry as the "pure solvents" option. This would cut emissions by 80 per cent or more, according to a Calgary-based company called Nsolv.

In addition to removing the need for water, the process produces a less viscous form of bitumen, meaning it could be able to be sent through pipelines without the usual need to dilute it with another chemical, depending on which pipeline is being used. According to the Canadian Energy Research Institute, the absence of diluent saves $4 per barrel. To make the pure solvents option viable, though, companies need to prove they can recover and reuse the injected solvents and keep them from contaminating groundwater.

Nsolv thinks it has the answer to this.

At the end of May, the Calgary-based company wrapped up operations at its 300 bpd pilot plant, located at Suncor’s Dover site.

In an interview with National Observer, Nsolv CEO Joe Kuhach said the pilot project achieved a solvent recovery rate of over 95 per cent, adding there was “no containment issue” because pure solvents are put to work at low pressures. That means the risk of the solvents leaching out beyond the reservoir would be minimized. While Kuhach couldn't offer many specifics about the project due to its proprietary nature, he said the emissions savings and solvent recovery targets had all been met. In an indication that the technology is still in development, the Alberta Energy Regulator acknowledged that it’s not yet developing regulations for the use of solvents.

The Council of Canadian Academies also noted in a 2015 report that "insufficient information exists" on the potential impacts of solvents on groundwater quality. Adkin, the University of Alberta professor, said that "there's almost no research on the environmental impacts of pumping solvents into these wells."

Solar, wind and oil combined with radio waves in the oilsands?

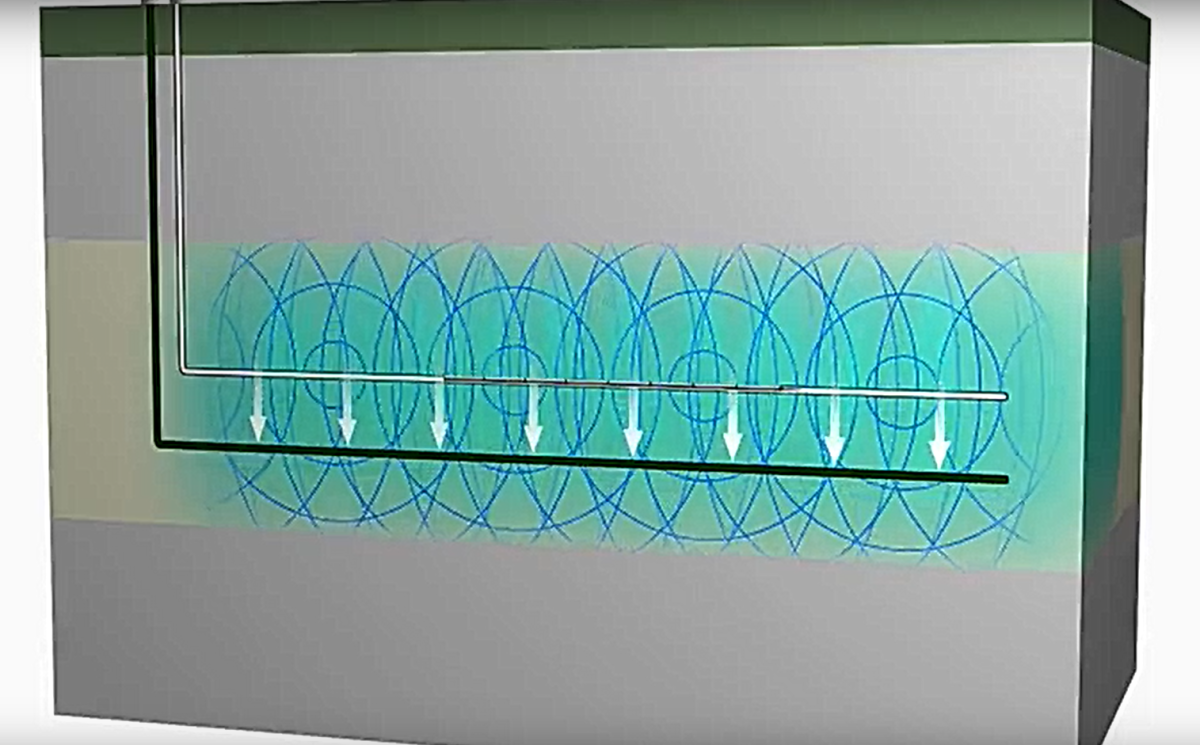

It may seem like science fiction, but in another scenario electromagnetic heating is used to bring bitumen to the surface instead of steam. This process uses radio waves to produce the necessary heat. Wicklum of Canada’s Oil Sands Innovation Alliance suggests that electromagnetic heat could be produced from wind and solar power and used in conjunction with steam-based technologies.

However, electromagnetic heating would result in considerably higher per-barrel costs than standard SAGD processes. The Canadian Energy Research Institute calculates that installing antennas would add up to approximately $8-$10 million more at every site and increase per-barrel costs by between 27 and 30 per cent. As futuristic as it sounds, a finished electromagnetic heating site would look very similar to a current SAGD site, with two wells drilled — one for steam injection and the other for bitumen extraction — except it would be radio waves, not steam, agitating the bitumen.

In May, Suncor announced that it intended to apply for approval to use electromagnetic heating combined with solvents at its proposed Lewis project near Fort McMurray, which could be constructed around 2024. That follows its pilot project at the company's Dover project near Fort McKay, north of Fort McMurray.

Changing how steam is made in Canada's oilsands

Another option for the industry is to change how steam is actually generated. Wicklum compared the current process of generating steam for SAGD to “heating the water in a kettle,” in which the bottom of the boiler is warmed with a flame from burning natural gas. The associated emissions are released straight into the atmosphere, where they contribute to trapping heat and raising global temperatures.

Direct contact steam generation would completely alter the approach, forcing processed wastewater directly through a flame that uses pure oxygen as a fuel, in order to attain higher temperatures and lower fuel input.That creates around 90 per cent high-pressured steam and 10 per cent carbon dioxide, which can then be sequestered underground. The process almost completely removes the need for freshwater.

The technology has been largely developed by Natural Resources Canada via the CanmetENERGY unit over the course of two decades. An injection trial at Suncor’s MacKay River facility indicated carbon dioxide retention rates of over 90 per cent, according to Bruce Clements, CanmetENERGY group leader and research scientist. “However, I wouldn’t write home yet about any of these numbers as this is the first stuff,” he added in an interview with National Observer.

Clements said CO2 might start to escape over time as more of it is placed underground over decades.

However, high temperature corrosion issues have been effectively addressed by plating vessels and lines with alloys, he added. CanmetENERGY is looking to commission the launch of the first “hot test” in February, after which they’ll experiment using tailings water at an Ottawa-based facility. A 2017 study by Princeton University that modeled potential leakage rates from carbon capture and storage at 42 injection sites concluded that even in the "extremely high leakage case," only 0.005 per cent of the carbon dioxide will migrate into the groundwater aquifer after 50 years.

Natural Resources Canada recently put the call out for letters of interest from companies to enter into a commercial licensing agreement for the technology.

New tech may mean new oilsands projects

Wicklum, from Canada's Oil Sands Innovation Alliance, pointed to the group’s ongoing Carbon XPRIZE as an example of industry innovation, awarding $20 million in prizes to teams that design new ways to utilize captured carbon to create new products such as concrete, biofuels and fertilizers. There's also significant potential to install cogeneration, the name for systems that can generate both electricity and useful heat, at existing facilities.

On Dec. 4, Suncor announced its intent to replace boilers at its Base Plant in Fort McMurray with two such "cogen" units by 2022, generating about 700 megawatts of electricity to be sold into the grid.But, as noted in a 2015 report by the Council of Canadian Academies on technological solutions for the oilsands, the size and cost of oilsands projects often leads to risk aversion, which “may lock in existing technologies and delay deployment of environmentally superior alternatives.”

A 12-member panel on the subject was co-chaired by Eric Newell, former Syncrude CEO and University of Alberta chancellor emeritus, and Scott Vaughan, International Institute for Development president and CEO. Nsolv’s Kuhach said that many companies don’t have a lot of dollars to play with, leading to a “bit of a cautious attitude.” Adding to the complexity is that oilsands deposits vary greatly in quality, meaning that a technology that works in some regions may not work in another.

Bryan Remillard, manager of oilsands at the Canadian Association of Petroleum Producers, an oil and gas lobby group, wrote in an email that “clear opportunities exist [for] industry and government to work together to meet common goals.” He cited the Alberta Oil Sands Technology and Research Authority of the 1970s and 1980s, a provincial Crown corporation that helped develop SAGD. Kuhach of Nsolv suggested that some revenue from “punitive measures” like Alberta’s carbon tax could be recycled into the sector through mechanisms like low-interest loans.

The oil sands innovation alliance's Wicklum advocates for more public investments like the $20 million recently invested by the provincial and federal government in Calgary’s Alberta Carbon Conversion Technology Centre.

“Additional government investment would definitely speed things up,” he said.

Environmentalists skeptical of tech's promise

In separate interviews with National Observer, staff from Oil Change International, Environmental Defence and the International Institute for Sustainable Development (IISD) all agreed that solvents and direct contact steam generation are technically feasible and would reduce greenhouse gas emissions from the oilsands. They all expressed concern, however, over the idea of maintaining and expanding investments in oilsands research and development, suggesting that this only perpetuates and “locks in” fossil fuel usage, as opposed to transforming society towards low-carbon technologies and systems.

“There certainly are some GHG benefits from some of these things,” says Philip Gass, senior energy researcher at IISD. “But the point is that it is still support for continued use of fossil fuels over other alternatives. That’s where it is definitely still a subsidy to fossil fuels even if there is some benefit.”

Such “subsidies” can take the form of direct investments in technologies like carbon capture and storage — on which provincial and federal governments have spent over $2.5 billion — or publicly-funded research facilities, like the CanmetENERGY centre in Devon, Alberta. Adkin has calculated that Emissions Reduction Alberta has invested over $61 million in SAGD research, with the federal government spending $150 million in University of Calgary and University of Alberta research facilities.

Scott notes that the world will have to effectively phase out the use of fossil fuels within 50 years in order to avoid the risk of catastrophic climate change. Many oilsands projects are extremely capital intensive and intended to operate for 40 to 50 years, he says, meaning there is “massive financial incentive to keep the project running to pay itself off and generate profits.” In other words, while per-barrel emissions may drop because of such technologies, production will likely increase in tandem and potentially cancel out reductions.

Questions remain as well for environmentalists about the environmental impacts of the technologies, including the impacts of unrecovered solvents and the longevity of underground CO2 storage over time. As Pembina’s Israel wrote in a recent blog post about solvents, “the oilsands industry has a long history of broken promises when it comes to mitigating its impact on the landscape.” He cited 1.2 trillion litres of tailings waste as an example.

That leads some to conclude that while technically viable, it would be best for Alberta and Canada to massively scale up investments in clean tech and remove incentives and funding for oilsands production instead. “We really need to focus on the energy and technology sources that are part of the new economy, not part of the old,” said Tim Gray, Environmental Defence executive director. “The degree to which Canada tries to continue to subsidize the old will determine what our employment and economic future is."

Graphic at top of piece by Mac Boucher for National Observer

Comments

What is often forgotten is that the natural gas used in the oil sands comes from fracking the rest of the province, a technique which has been outlawed in a growing number of countries worldwide. We are risking Alberta's future for a technique which is meant to support oil sands operations, replace coal fired plants with something worse for the province and enrich companies who wish to export our resources for profit. Royalties are so low that they will not meet the need for health care resulting from this ignorant and brutal process. Our dependence on this industry is making Alberta poor. Subsidizing this industry is suicidal for our environment and our children's future.

How many times and for how many years/decades have we heard about new technology soon to arrive to ‘clean up’ Fossil Fuel Production? Nothing of any significance yet. The Industry still has no idea how to ‘clean up’ the tailings ponds for oil (nor for uranium tailings).

The industry has known for decades that fossil fuels will ultimately destroy the habitat of humans and a multitude of other species. Did they do anything back then? No.

Why on earth do we now invest public dollars on the riskier path of ‘hoping’ that we could, magically, extract Tar Sands bitumen, then convert it into a carbon-free product! Desperate plans for a dying industry and a dying Petro State.

After reading only half this article, I'm SICK!! All this is SUCH a complete and utter WASTE of time, resources, money, environmental value, etc., etc.!! And as long as citizens permit government to continue to aid industry in carrying on fiddling around with different ideas, keeping themselves in a job, WE are just as guilty!!

WAKE UP, CANADA, and put an END to this madness!!