Support strong Canadian climate journalism for 2025

The developing world is now driving the deployment of clean energy technology, while wealthier nations are stepping back on new builds, says a new report.

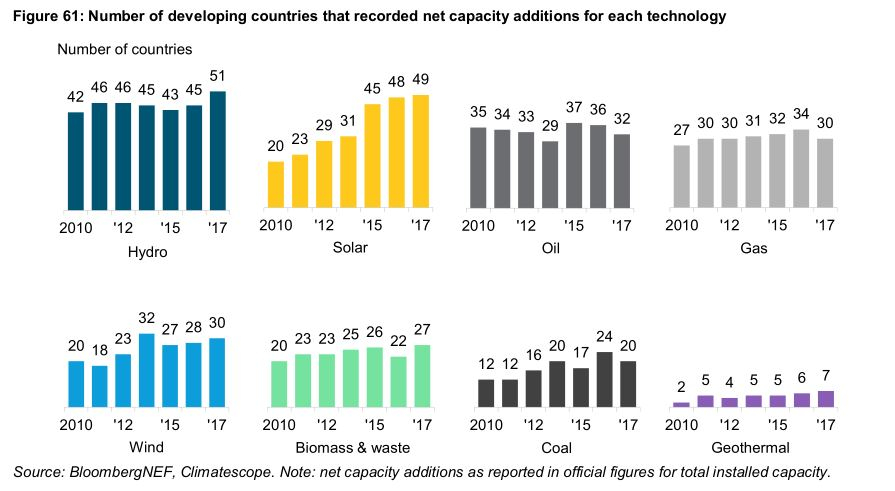

The number of developing nations that recorded a net year-over-year increase in solar, wind, hydro, biomass and geothermal power increased, while the number installing oil, gas and coal decreased, according to the annual Climatescope survey by BloombergNEF of 103 nations.

Overall, new clean energy deployment rose over 20 per cent year-over-year in developing nations compared to a drop of 0.4 per cent in wealthy countries. Solar power has seen particularly robust growth: 49 emerging markets installed solar capacity last year, up from just 20 in 2010, the survey indicated.

Last year also marked a “key milestone” in the march toward clean energy across the planet, stated the survey. For the first time, developing countries added more clean energy than fossil fuel capacity last year. It said 52 per cent of all capacity installed was wind and solar — a major jump from five years ago, when it was just 14 per cent. This represents a massive shift from a decade ago when wealthy nations were driving both investment and deployment of renewables.

“Middle-income developing countries represent some of the very hottest markets for clean energy deployment today,” the survey read. “There is no shortage” of examples of developing nations “where clean energy development has either taken root or is in the process of doing so.”

Power must decarbonize to mitigate climate crisis

The world’s top climate scientists say significant decarbonization of the planet’s electricity generation is critical to human survival in the 21st century. Humans must derive their power primarily from renewable or non-emitting sources by 2050 if the planet is to avoid more destructive effects of climate change.

The Intergovernmental Panel on Climate Change (IPCC) has concluded that in order to stay within a middle-of-the-road scenario of carbon mitigation — where Earth’s warming is limited to 1.5 degrees Celsius above pre-industrial levels with limited overshoot — renewable power sources must achieve a minimum 63 per cent share of the global electricity market by mid-century.

This translates to an annual average investment of US$2.4 trillion between 2016 and 2035, the IPCC said — or about 2.5 per cent of the entire world’s GDP.

Prime Minister Justin Trudeau's principal secretary Gerald Butts seized on the Climatescope survey to highlight the connection with climate change in a tweet.

This month, Finance Minister Bill Morneau proposed a new tax incentive for businesses investing in wind turbines and solar panels in Canada. Morneau's Nov. 21 fiscal update proposed a new "immediate expensing" temporary rule that would allow businesses to write off the full cost of "specified clean energy equipment" on their taxes.

The finance minister also proposed another new incentive that would apply to oil and gas sector property expenses, tripling tax depreciation on certain Canadian oil and gas property expenses.

Coal power still dominates, but set to decline

In 2017, finance for new clean energy projects in developing nations was US$143 billion, the Nov. 26 BloombergNEF survey indicated. That was approximately the same as the year prior, and lower than the peak of US$178 billion in 2015 — but also comes as renewables continues to drop in price.

While emerging markets still rely on power generated predominantly from coal, gas and oil, 45 of them installed more carbon-free power than fossil fuel capacity — including economic giants China and India. Fossil fuel sources accounted for 40 per cent of capacity in 2017, falling from 66 per cent in 2012.

Coal power still dominates global power generation at 38 per cent. But Climatescope said its use is set to peak in 2027 and could drop to 11 per cent by 2050. What’s pushing coal out of the picture in the developing world is the drop in price of renewables and cheaper batteries, along with a proliferation of another fossil fuel, natural gas.

“The relative economics of renewables and coal, and the capacity of governments to recognize these tipping points when planning their energy systems, will be fundamental in shaping the de-carbonization path of the world, and emerging markets in particular,” states the report.

Even so, the survey warned it is “far from certain” that developing countries will be able to decarbonize their existing power sectors. Actual generation from coal-fired and natural gas generation rose a few per cent year over year. Around 86 per cent of coal-fired generation under construction is due in China, Indonesia, India and South Africa, the survey said.

China and India “get approximately two thirds and three quarters of their power from coal, respectively. Combined, these two countries added 432 gigawatts of coal capacity in just 2010-2017."

Neither China nor India are in the Canada and U.K.-led Powering Past Coal Alliance, where 28 countries as of October 2018 have promised to phase out coal-fired power generation.

To create the survey, BloombergNEF gathered 42 analysts and made 54 country visits for data collection and interviews. Out of the 103 nations examined, 100 are classified as less developed by the Organisation for Economic Co-operation and Development, and the other three — Chile, Mexico, and Turkey — were added because the organization believed they were important to include. The survey was financially supported by the United Kingdom’s Department for International Development.

Comments

Ah! another sign of the apocalypse. The "underdogs" are outstripping the aging uber economies. Senile sclerosis has invaded the old order which has depended for generations on slave economies - literally colonized slave territories from which they stripped wealth, and in the process enslaved themselves to the exploitative capitalist business model and the "cheap" petro-energy model. As history is proving, unsustainable energy is anything but cheap. In addition to the economic burden of the entrenched obsolescent infrastructure that must be cleared away (and cleaned up) we are lagging badly in the entrepreneurship, the innovation and the investment required to move forward into a survivable and sustainable future.

Sometimes it pays handsomely to be "underdeveloped"!