Support strong Canadian climate journalism for 2025

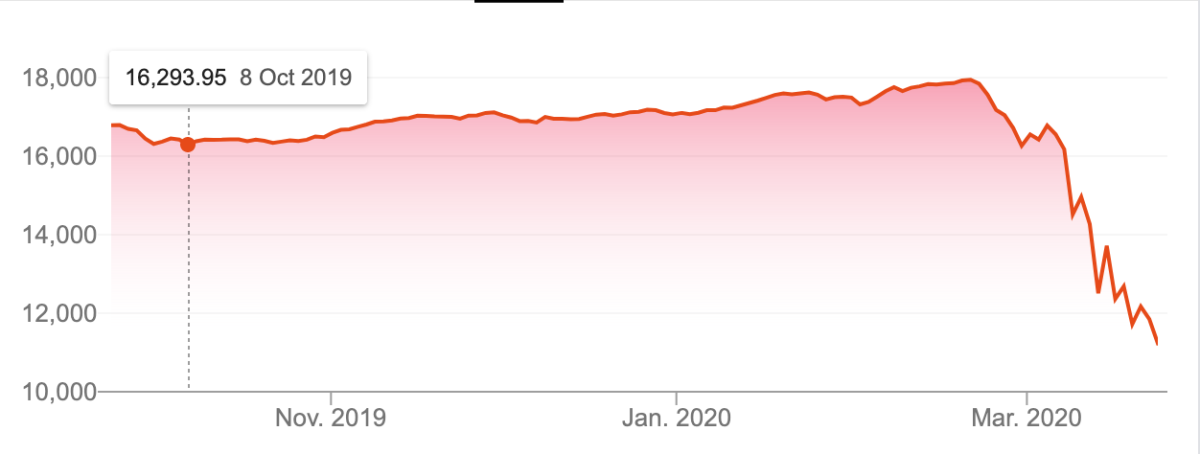

Canada faces an unprecedented economic slowdown — the price of measures to contain the COVID-19 pandemic — that could take years to recover from, economists warn.

The fallout will emerge in stages, with estimates of the long-term damage largely dependent on efforts in coming weeks to both contain the outbreak and the risk of economic contagion.

“The speed at which we can come out the other side really depends on how much of the economy is left intact once we get through this,” said Nathan Janzen, a senior economist at Royal Bank of Canada.

The immediate risk is to the livelihoods of some two million workers in retail stores, hotels and restaurants, airports and other businesses that are either forced to close or are sharply curtailed, Janzen and other economists said.

The knock-on effects come when these people start missing rent and other bills, and the businesses that employ them decide they’re unable to re-open when the worst of the crisis passes.

Economists say an extended period of global economic malaise would in turn lead to a retrenchment in Canadian manufacturing. That would be exacerbated by extended restrictions at the border with the United States, by far Canada’s biggest trading partner and likely the next major epicentre of the global pandemic.

Slumping oil prices will further slow any recovery in the country’s energy sector, a major source of export income. While industries such as air transportation will struggle as long as global traffic is disrupted. Many households will likely remain reluctant to spend even after business closures are loosened, says Janzen.

“There’s a risk to all economic activity if demand for everything is lower, then production of everything is going to be lower, and I don’t know that there’s an industry that’s immune to that,” Janzen said.

He said Canada’s gross domestic product for the second quarter of the year could fall by double digit percentage points, and that “the first digit might not be a one,” while the unemployment rate may well have spiked above 10 per cent, compared to 5.6 per cent in February.

While the Conference Board of Canada expects the worst of the crisis to pass within a couple of months, it also put out an alternative outlook on Monday that considered the impact of Canadian and U.S. travel bans and social distancing stretching into August.

Their verdict? Real gross domestic product would fall by 1.1 per cent in 2020. In December 2019, they had expected 1.8 per cent growth for 2020, but trimmed their baseline assumption to 0.3 per cent growth in the early days of the pandemic.

That alternative scenario could prove too optimistic however, with an estimate that some 330,000 people lose their jobs in the middle six months of the year, pushing the unemployment rate to 7.7 per cent.

Some 929,000 people applied for federal Employment Insurance last week, Bloomberg reported on Tuesday, citing an official with knowledge of the data. A nearly 80 per cent increase to the 1.18 million unemployed people in Canada in February, according to official statistics.

“The kind of numbers we’re pencilling in right now are that we’re going to be feeling the effects of this not just this year, maybe not just next year,” RBC's Janzen added.

Prime Minister Justin Trudeau rolled out an $82 billion COVID-19 relief package for workers and businesses on March 18, which RBC pointed out is a significantly smaller portion of GDP than other developed economies have offered. Trudeau has said there's more to come.

But government intervention, while useful over the longer-term, isn’t going to save the short-term hit to the economy, RBC’s Janzen said.

“Putting more money in people’s pockets doesn’t help when you are telling people to stay at home, explicitly telling people not to go out and spend their money.”

The worry for David Macdonald, a senior economist at the Canadian Centre for Policy Alternatives, is that the money might not get in the hands of those who need it quick enough.

Close to half of working renters in Canada — or 1.6 million households — don’t have enough savings to pay their bills for more than a month if they lose their jobs, CCPA said in a new analysis released on Monday, with some 830,000 of those households unable to handle a week without pay.

“In the same way that patients with COVID-19 require rapid and accurate treatment, employees that have been laid off in order to contain COVID-19 also require rapid and immediate economic treatment,” he said. “Timing is a critical concern of mine.”

Macdonald says the EI system will require significant changes to make it fit to the task, given it typically takes almost three weeks from application to first payment at the best of times and is now overloaded with applications while Service Canada staff are not working at full capacity.

“The old rules and the bureaucratic, Byzantine process of application will have to be thrown away in favour of moving the money out quickly,” he said. “They’ll probably have to start enforcing payment, perhaps after 14 days they just start paying and work out the details after the fact.”

Comments

i wonder if your economist and others serving the banking industry are prepared to guarantee that nobody who misses mortgage payments because of job loss by pandemic will be foreclosed on? Like an interest free period? Fat chance. CMHC will probably have to adopt the lot. Which will bail the banks out...again. So socialism for the financial sector, precarious welfare for working people.

Finance never loses. They benefited immensely from the real estate bubble, and in the end the state will the risk out of their investments. Time for a bank that has public purpose as its mandate. The others should be consigned to the dustbin of history or confined to bankrolling their fellow players in the stock-market casino.

If the current crisis crumbles from recession to depression the NDP might be compelled to pluck up the courage to re-introduce "socialism" into their constitution. As unlikely as it sounds, they might even mean it.

i wonder if your economist and others serving the banking industry are prepared to guarantee that nobody who misses mortgage payments because of job loss by pandemic will be foreclosed on? Like an interest free period? Fat chance. CMHC will probably have to adopt the lot. Which will bail the banks out...again. So socialism for the financial sector, precarious welfare for working people.

Finance never loses. They benefited immensely from the real estate bubble, and in the end the state will the risk out of their investments. Time for a bank that has public purpose as its mandate. The others should be consigned to the dustbin of history or confined to bankrolling their fellow players in the stock-market casino.

If the current crisis crumbles from recession to depression the NDP might be compelled to pluck up the courage to re-introduce "socialism" into their constitution. As unlikely as it sounds, they might even mean it.

It depends on how quickly we contain this virus. Recall that once WWII ended, a completely devastated Japan recovered economically quite quickly, probably because they had a well-trained and educated workforce.

The assistance provided to people who become unemployed seems to take for granted that these people MUST pay their debt (mortgages, credit cards, loans). That is totally unfair: most businesses, large or small, will lose income and profit. So, why should financiers be sheltered from loss when everyone else suffers? It is about time that the governments stamp on the finance kings and oblige them to REDUCE the debts. Imposing socially acceptable controls on the finance sector would also reduce the housing crisis which is due to unacceptable speculation.