In the North, some mines risk leaking acid if the permafrost melts, while across Canada heavier rainfall will add strain to tailings dams and a lack of it could throw operations.

While no strangers to extreme weather, the growing risks from climate change are forcing the mining industry to take a hard look at their methods, and how to prepare for the worst. Many of the most prudent actions to minimize risk are, however, also more costly, meaning that while some have taken them on, not everyone has followed suit.

"This is a serious and emerging problem," said Jamie Kneen, Canada program co-lead at advocacy group MiningWatch Canada.

Kneen said his biggest area of concern is around how mining companies manage the waste they generate, and the dams they use to contain it. Companies are increasingly digging up lower concentrations of metals, meaning there is more waste to deal with after. And while many mines last less than a decade, the tailings they generate are a much longer-term problem.

"We've got, you know, tailings dams that are getting bigger and bigger at the same time as the climate risk is getting bigger," said Kneen.

Given the risks, companies are leaning more on alternative ways to manage the vast volumes of rock and contaminated water generated by extraction, said Bruno Bussière, a professor of mining at Université du Québec en Abitibi-Témiscamingue.

Some of those methods include removing much of the water from the waste so it can be piled dry to make it more stable. Companies are also more often pushing waste back into mine shafts and open pits to reduce the risks, he said.

"We have to see an open pit as an opportunity."

Moving millions of tonnes of rock back into a hole or adding a water removal step for tailings, however, doesn't come cheap, so it becomes in part a question of how much value a company sees in it, said Bussière.

“Clearly it adds costs, short term costs, capital costs, but you reduce the risk. So what is the price of the risk? That's what they have to decide.”

Climate change is changing that equation for some, as the uncertainties ahead mean that companies sometimes have to assume the worst possible scenarios.

Companies are also shifting methods as they're pressured to improve their ecological profile more generally, while recent mining disasters, including the 2019 tailings dam failure at a Vale S.A. mine in Brazil that killed 270 people, and the 2014 dam breach at an Imperial Metals Corp. mine in B.C., have led to higher standards for dam management.

For example, in Nunavut, Agnico Eagle Mines Ltd. has gone with dry tailings at its Meliadine mine, in part to improve resilience to future climate change, while it's already had to expand water storage at its northern mines because of more frequent extreme rainfall. It's also still working through the best way to cover a satellite deposit of its Meadowbank mine to make sure the waste rock doesn’t thaw and generate acid.

“Dams (and) standards are evolving. So we need to make sure that we're ahead of it, because it's way more expensive to go back and fix a dam than to build it right the first time,” said Mohammed Ali, vice-president of sustainability and regulatory affairs at Agnico.

The company is looking at a range of adaptations elsewhere, such as to site access during wildfires, and skeleton-crew scenarios for when staff with kids can’t make it to work because schools are closed due to extreme heat. It's also considering more automated underground machines as higher temperatures make for tougher working conditions underground.

Other companies, such as Glencore at its Sudbury, Ont. operations, have already seen an increased number of down days because of rules requiring production to be halted when temperatures underground top 31 degrees.

The industry is doing more on adaptation as the data gets better, and as disclosure requirements increase, said Ali.

“The financial world is saying, I don't want to put money into a place where there could be a financial risk of some climatic event, and I lose my investment. So that's where the drive has come on adaptation.”

Disclosures show the wide range of actions companies are having to take on adaptation. Teck Resources Ltd. in its latest climate report noted that permafrost thaw is adding silt to the water at its Alaska operation that it needs to deal with, while in B.C. it is working on spring runoff management and flood mitigation projects. In Chile it's working on measures to use less water including the construction of a large-scale desalination plant at its QB2 project.

BHP has also spent billions of dollars building desalination plants in Chile to manage both immediate and long-term water shortages.

“Those were big investments at the time, but it was also looking ahead and seeing that’s where we needed to go,” said Caroline Cox, who oversees sustainability at BHP as chief legal, governance and external affairs officer.

At its massive Jansen potash project in Saskatchewan that could last 100 years, BHP has gone with conventional mining rather than using hot water to extract the minerals. The decision, which carries more upfront costs, means it will use about 60 per cent less fresh water and will create half the emissions of other potash mines, she said.

The growing push for adaptation is a contrast from only a decade ago when Natural Resources Canada started to ramp up consultations on the issue, said Pamela Kertland, a program manager in the department’s climate change impacts and adaptation division.

“There was a perception almost globally that adaptation was something in the future.”

Along with growing acceptance and data are improved planning tools, such as a how-to guide for adaptation put out by the Mining Association of Canada last year with financial support from the federal government.

Provincial governments have also started to catch up to the issue. Places like Quebec and Nunavut require companies to explain how they’ve taken into account how climate change might affected operations as part of environmental reviews, while Yukon has committed to getting such rules on the books this year.

Governments, however, are falling short on forcing some of the preparation needed, said Kneen at MiningWatch.

“Governments are taking steps to regulate this, but they're very cautious, and the industry as well is trying to address this, but I think I would say that they're not going far enough fast enough to meet the challenge.”

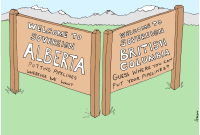

He said there are some improvements, such as companies no longer proposing the most dangerous type of tailings dam, but that it’s still voluntary whereas other countries including Brazil and Chile have outlawed the practice. Provinces like British Columbia, unlike Quebec, also still allow mining companies to gradually pay into reclamation bonds, which raises the risk of taxpayers being left with the bill as climate risks increase.

There’s also the concern that while big players can afford to splash out on best practices, smaller companies with shorter mine lives may not think climate adaptation is so important, and not worth the cost of doing it right, said Kneen.

“It's expensive, and part of what we've been trying to impress on industry and regulators alike is that if you have a higher standard, it's good, it may be more expensive. And if you can't afford it, if the market isn't justifying that, then you actually don't have an economical project.”

This report by The Canadian Press was first published Oct. 20, 2022.

Comments