Support strong Canadian climate journalism for 2025

Four years ago, Canada crafted a plan to capitalize on a global hydrogen market the government expected to be worth up to $11.7 trillion by mid-century. Billions of dollars of public money has been provided to seize the country’s share of the pie.

But there’s a problem: the global market is shrinking before their eyes.

In a hydrogen strategy progress report published in April, Natural Resources Canada noted by 2050 the global hydrogen market is now expected to be worth $1.9 trillion. That’s a seismic, 84 per cent drop from the estimate the same ministry offered just four years ago to justify the tremendous sum of money Canada made available for companies to scoop up.

The department explained the initial estimate was sourced from Goldman Sachs, and the new $1.9 trillion estimate comes from a 2023 Deloitte report.

“As with any nascent industry, there is a degree of uncertainty, especially with long-term forecasts, as each forecast is based on a number of assumptions,” Natural Resources Canada said in a statement. “The values provided in the reports are intended to give a sense of direction and scale of the potential opportunity for Canada when it comes to hydrogen.”

The government also said this isn’t the end of the uncertainty.

“It is expected that these values will continue to be revised as these forecasts and their underlying assumptions are updated over time.”

The money flowing from government to encourage the industry’s development, however, has continued apace.

On Wednesday, at an annual meeting of energy and mines ministers, federal Energy and Natural Resources Minister Jonathan Wilkinson announced $8.5 million for the country’s hydrogen sector, with the money flowing to companies like Aurora Hydrogen, ATCO Gas and Pipelines, and New Wave Hydrogen.

Wilkinson, who before his time in politics was the CEO of clean-tech companies, including a hydrogen company called QuestAir Technologies, said that beyond climate change harming the world’s natural environment, it’s also reshaping the global economy and creating an opportunity on a scale not seen since the Industrial Revolution.

“For Canada to seize the extraordinary opportunities being created by the transition to a net zero economy, we must first accept the scientific reality of climate change, and then ensure that this informs and shapes Canada’s economic strategy,” he said.

Beyond the millions announced last week, the federal government has introduced a clean hydrogen investment tax credit worth $5.7 billion over five years; a $1.5 billion Clean Fuels Fund that, as of October, has provided hydrogen projects with over $300 million; has provided over $300 million for two hydrogen projects through the Strategic Innovation Fund - Net Zero Accelerator; committed $777 million to hydrogen infrastructure through the Canada Infrastructure Bank; and also makes funding possible through regional development agencies like PacifiCan, PrairiesCan, FedDev Ontario and the Atlantic Canada Opportunities Agency.

Brute-forcing the industry

Green and blue hydrogen — produced using renewables or from natural gas with carbon-capture — are the primary products Canada is looking to sell abroad, and according to Wilkinson the country is well equipped, thanks to its geography. Green hydrogen made in Atlantic Canada using the region’s wind power can be exported to European countries, while blue hydrogen produced in Western Canada using vast natural gas deposits could be shipped to Asian markets.

With federal policymakers sensing this economic opportunity, billions of dollars of public money is being used to “brute force” the birth of the Canadian hydrogen sector, Adam Scott, executive director of Shift: Action for Pension Wealth and Planet Health, told Canada’s National Observer.

“The hope was, ‘We'll create the seeds of a hydrogen supply chain and then people will buy it,’ … but the idea that this is going to become a major industry in any reasonable amount of time? There's just no evidence for it,” he said, calling it “hype.”

Scott said Canada’s hydrogen strategy started on the wrong foot. Rather than recognizing that burning fossil fuels must be phased out to avoid catastrophic warming and asking what technologies can help, the “question was: we have this existing legacy gas industry, how can we protect them from this [energy] transition?” he said.

Wilkinson’s office did not return a request for comment before publication, but during a press conference last week, he said the country’s resource economy, including the oil and gas sector, has to be thoughtful about the energy transition if it wants to pounce on emerging opportunities.

He said the oil and gas sector “will eventually be a declining global market,” and to protect competitiveness, emission reductions will be crucial as markets embrace low-carbon products. For the gas industry, that means “focusing on ultra low carbon hydrogen,” he said.

As previously reported by Canada’s National Observer, documents obtained through a federal access to information request revealed Natural Resources Canada tapped the Canadian Gas Association alongside fossil fuel giants Suncor, TC Energy and Arc Resources to help craft the country’s hydrogen priorities.

Critics say it doesn’t make sense to build a hydrogen sector using emissions intensive natural gas when demand is uncertain, and cheaper, less polluting options exist.

“There are applications for hydrogen that make sense, but the uses are a tiny fraction of what [hydrogen supporters have] been talking about,” Scott said, pointing to some niche industrial applications and long-duration energy storage as examples. “It's not a core technology to the transition at all. The vast overwhelming majority of the energy transition will come from electrification.

“So the hype has been built by industry, and by government doing their bidding, and the stories are all fictional,” he said.

Invest in Canada shells out for sponsored content

One of the ways Canada has promoted foreign investment in its hydrogen sector is through Invest in Canada, an arms length body under Global Affairs. Since 2021, marketing hydrogen has been one of its strategic priorities.

Invest in Canada rolled out a sponsored content campaign called, “The next best place to home,” with the Financial Times in April 2021. The campaign describes Canada’s “hydrogen revolution” and tells prospective investors that Canadian hydrogen “represents a once in a generation opportunity” to capitalize on a market expected to be worth over $10 trillion by 2050.

The campaign goes on to tell readers that the hydrogen sector enjoys support from both federal and provincial governments, and investments are being made to build the broader hydrogen economy by researching the role of hydrogen-powered vehicles.

Invest in Canada did not return a request for comment about its efforts to promote hydrogen.

Disappearing use cases

Scott says the reason hydrogen demand has fallen so much in a short time is because proponents of the sector pitched hydrogen as a solution for a wide range of uses. To supporters, hydrogen can be used in transportation; can be used in place of natural gas to heat buildings; and can help decarbonize heavy industry like cement and steel manufacturing. But instead, as the hydrogen sector struggles to get off the ground, electric options have barreled ahead with a lower cost and better climate performance.

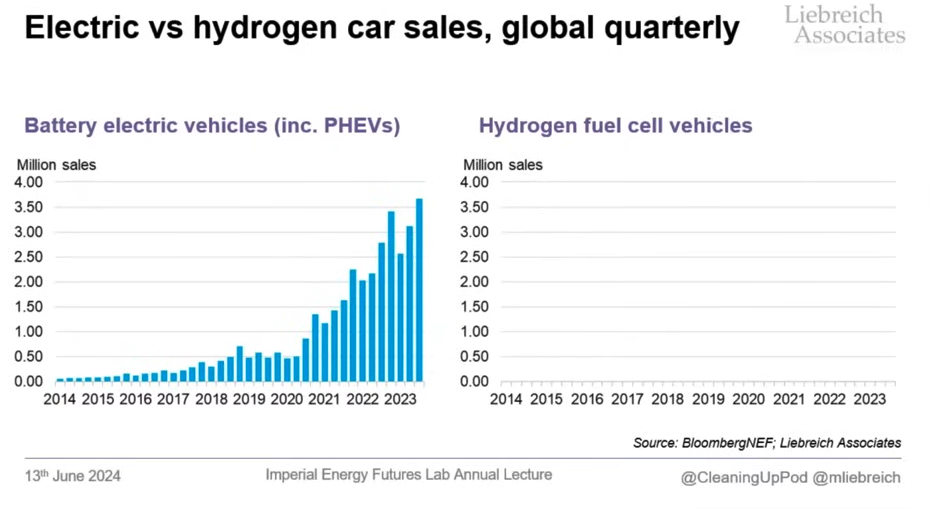

For instance, Scott says the race between electric and hydrogen powered vehicles was lost years ago. Hydrogen-powered vehicle sales are plummeting. Fuelling infrastructure hasn’t materialized, and the costs are “outrageous,” he said. Other transportation uses that initially seemed more promising, like short-haul ferries, long-haul trucking, and industrial equipment like backhoes, are also trending in the direction of electric battery usage rather than hydrogen, he said.

Using hydrogen to heat homes is another option that now has “no path forward,” he said. Blending hydrogen into the natural gas network can only be done in miniscule amounts; 20 per cent at best case scenario, he said. Practically, that means if jurisdictions were interested in eliminating emissions from buildings with hydrogen, it would require ripping out and replacing the entire gas grid.

“You're just not going to do [that] when electric energy is already here and cheaper and better,” he said. “We already have the wires running into our homes. We don't need new infrastructure to do it.”

With transportation and buildings falling off the table as smart uses for hydrogen, the expected demand is falling. Industrial uses and long-term energy storage are virtually all that remain. But even some industrial applications like steel manufacturing are going electric, like Algoma Steel’s electric arc furnace in Sault Ste. Marie, he noted.

- With files from Jimmy Thomson

Comments

Excellent article, thanks for doing this one. The hype around hydrogen has been crazy, including here in New Brunswick where the government's recent "hydrogen strategy" included a push to hydrogen powered vehicles. As noted in your article, that idea died decades ago. What is it with NRCan's policy advisors? They need more critical expertise in the department and to stop relying on the industry and their lobby for info.

Indeed. The very idea of building a domestic hydrogen distribution network from scratch when " wires already run to every home and business" carrying electricity is beyond naive.

This article reads like the poster child for what is wrong with just about any idea for continuing with fossil fuels in some modified format that doesn't burn a hole through our children's future. Gold rushes might be fun, but only if its public dollars the prospectors are burning their way through.

A clean electric grid is within easy reach....though some modifications in the delivery may be necessary in areas given to violent storms, tornadoes and such. Going down the blue hydrogen hole is a tunnel to nowhere.............it's real purpose is to save the life of the industry killing the planet.

We need to grow up, do the real math, and get off the capitalist boom and bust cycle. The booms only enrich the usual suspects, and the busts close schools, hospitals and universities to public access.

PLEASE: NO MORE PUBLIC MONEY FOR OLD TECH FIXES. IF THEY'RE GOING TO WORK, LET THE 'MORE EFFICIENT' PRIVATE SECTOR DO THE INVESTING. That's what real entrepreneurs are for.

Well said. I'd be careful about the private sector, though. It can be innovative and efficient, but then you've got huge corporations like Toyota which has staunchly resisted EVs and promoted -- nay, seriously hyped -- hydrogen. It is now one of the most indebted companies in the world ($200+B) and is being outcompeted.

The troubling thing about this story is that it so clearly reflects the Liberal's basic contradiction on climate.

Wilkinson's narrative is pretty clear on the demise of fossil fuels, but then he uses pretzel logic to try to protect aspects of his gas and oil donors and background by pushing industry's fantasy about blue and grey hydrogen and to elucidate how "there is still room" for fossil fuels in in the transition. There is the plan for green H on the East Coast, but federal support is blended with support for blue H elsewhere and the gross ignorance of its true emissions profile.

One foot in both camps. The Libs are about to be severely punished for that duplicity, something that the voters already tried to limit through weaker support and minority governments.

The problem is the alternative gang has both feet in the fossil camp and are determined to erase every bit of slow progress the Lib's have made on climate and environment, while also taking a chainsaw to medicare, housing, urban transit and what have you on the social ledger.

Denmark is looking better the closer we get to the next election. The one ray of light is the great power of pure economics when it gets behind cleaner and perfectly affordable renewables, and it's increasingly obvious that is the one thing that will pull the rug out from under powerful oil and gas interests more than anything else.

“It is expected that these values will continue to be revised as these forecasts and their underlying assumptions are updated over time.”

In other words: "we truly haven't a clue".

Which is too bad, because they ought to have a clue.

The problem is, to my way of thinking, that they are stuck trying to figure out how to save their status quo sacred cows, and don't actually get around to taking some necessary, obvious steps. As a result, uncertainty increases and attempts at prognostication become risible, as this example shows.