Support strong Canadian climate journalism for 2025

As regulators weigh RBC’s bid to acquire HSBC Canada, environmental advocacy groups warn the merger will make the country’s banking system more vulnerable to the risks of climate change and slow action to address the crisis.

Investors for Paris Compliance urged Canada’s watchdogs to consider how the merger will affect bank cross-ownership. The shareholder advocacy group argues the concentration of bank ownership that already exists in Canada poses a systemic risk to the financial system. The group shared its concerns Monday in a letter to Finance Minister Chrystia Freeland, superintendent of financial institutions Peter Routledge and Competition Bureau commissioner Matthew Boswell.

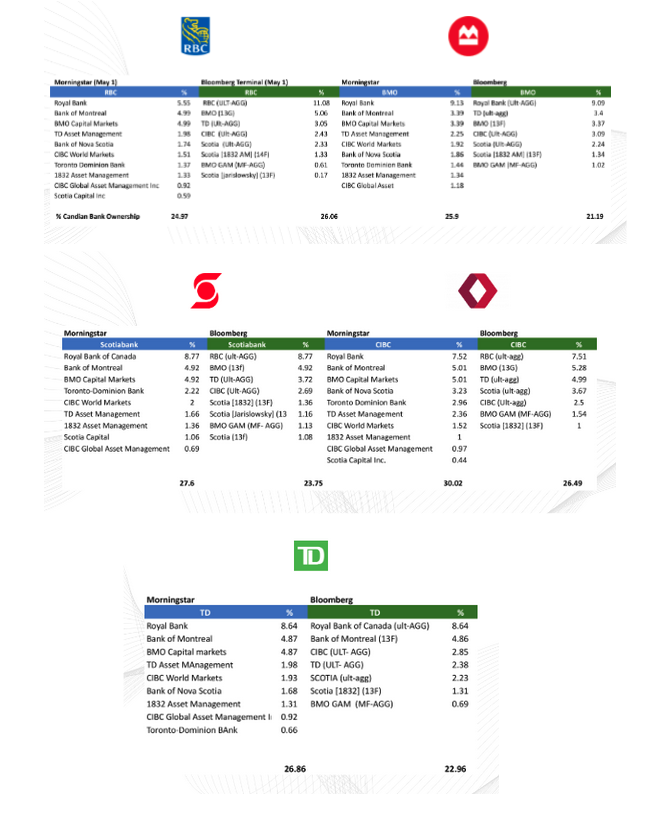

Cross-ownership refers to bank shares owned by other banks. According to financial data sourced from Morningstar and a Bloomberg Terminal, Canada’s five largest banks — RBC, Scotiabank, TD, CIBC and BMO — collectively own about 25 per cent of one another.

In the letter, Investors for Paris Compliance executive director Matt Price describes that finding as “a figure we believe is unrivalled in any advanced economy.”

Canada’s high level of cross-ownership is a barrier to shareholder democracy because it prevents other investors from “advancing alternative viewpoints to those of the banks’ management teams,” Price said.

“We believe this is a contributing factor to issues such as reducing climate risk at the banks, where there seems to be a common front in delaying action,” he wrote.

A second risk of cross-ownership is that financial problems, like fossil fuel assets suddenly losing value in the energy transition, would quickly spread, he argues.

“Bank losses would be felt most acutely by the largest shareholders of those banks, which turn out to be the banks themselves,” he wrote. “This is a recipe for risk contagion within the banking sector.

“Should the acquisition of HSBC Canada assets by RBC proceed, this will further concentrate the ownership of banking assets in Canada.”

Beyond bank cross-ownership, the major financial institutions are also significant shareholders of fossil fuel companies. Since 2016, the Big 5 have pumped over $1 trillion into coal, oil and gas. Last year, a Canada’s National Observer investigation identified one in five bank directors at those banks also sits on the board of a fossil fuel company, which could be a violation of their legal duties, experts say.

The letter comes days after 14 climate and Indigenous rights groups wrote to the Competition Bureau highlighting RBC’s climate record, urging the regulator to consider climate change in its review of the proposed acquisition.

“RBC has financed over $340 B in fossil fuels since the Paris Climate Agreement was signed, and in 2022 became the world’s #1 financial backer of fossil fuels,” the letter reads. “When challenged on its climate record it touts billions set aside for ‘sustainable finance,’ but RBC deemed a $1B Enbridge oil sands pipeline loan sustainable, and a 2023 report shows RBC puts $99 of its energy finance into fossil fuels for every $1 in renewable energy.”

The advocacy groups argue RBC’s track record is relevant because in comparison, HSBC Canada has taken more steps to deliver on climate change commitments, including last year announcing a “precedent setting” policy to stop financing new oil and gas projects. Meanwhile, RBC had that policy explicitly excluded from its bid for HSBC’s Canadian assets to allow for continued investment.

RBC’s decision directly contradicts the United Nations Intergovernmental Panel on Climate Change, which urges a rapid phaseout of all fossil fuels to prevent catastrophic warming, and the International Energy Agency, which says there can be no investment in new oil and gas projects if the world is going to meet the Paris Agreement target of holding warming to 1.5 C.

Efforts to align Canada’s financial sector with its climate commitments is slowly building momentum. Last year, Sen. Rosa Galvez tabled the Climate Aligned Finance Act, which spells out a number of ways to shift bank financing while reducing risks to the financial sector. The bill is currently making its way through second reading in the Senate.

Earlier this month, Liberal MP Ryan Turnbull filed a motion calling for the government to “use all legislative and regulatory tools at its disposal” to align the financial sector with the Paris Agreement. That motion received support from Liberal, Green, NDP and Bloc MPs.

“There is a widespread acknowledgement that we can only meet our climate targets if we leverage the transformative power of our financial markets, and therefore, we must use every regulatory and legislative tool at our disposal,” Turnbull said in a statement. “ We need an all-of-economy approach to win the battle against climate change.”

RBC spokesperson Jeff Lanthier said the bank's asset management arm has a “strict fiduciary duty to investors which guides its investment decisions,” and those decisions “are not influenced by other considerations, including the interests of RBC.”

Comments

Greed (or avarice) is an uncontrolled longing for increase in the acquisition or use of material gain (be it food, money, land, or animate/inanimate possessions); or social value, such as status, or power. This best describes RBC in all their exploitive polluting investments into our earths demise. A total example of how not to behave for the world to witness. A track record of underhanded back-room investment that would make satan blush.