Support strong Canadian climate journalism for 2025

Canadian insurance companies invested at least $19.5 billion in fossil fuels last year, increasing the very risks they’re on the hook for, as climate change makes wildfires and flooding worse.

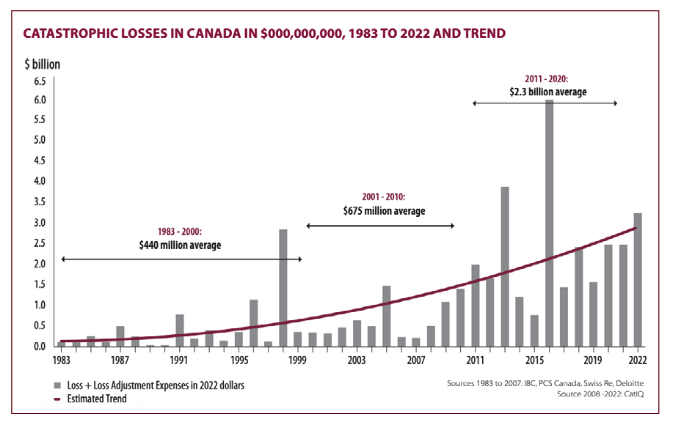

At the same time property and casualty insurance companies have invested in and provided insurance to coal, oil and gas companies, the insurance industry estimated it paid out $3.4 billion in damages last year –– with a significant chunk linked to the catastrophic wildfire season, according to Investors for Paris Compliance, which identified the financing.

In a report published Wednesday, Investors for Paris Compliance described a damaging cycle where the insurance sector supports the fossil fuel industry’s growth, which increases global heating and leads to more extreme weather, in turn causing worse damage to property. That translates to individuals and businesses paying higher premiums, and governments picking up the tab for infrastructure damage. The report accuses the industry of offloading risks and costs of the climate crisis to the public.

The industry financing fossil fuels while making net-zero commitments exposes the insurance industry’s “double-speak on climate,” says Investors for Paris Compliance senior analyst Kiera Taylor. “They're really entrenched in that contradiction.”

“While their business model faces this kind of existential threat due to climate change… they continue to foster those very risks through underwriting and investing in fossil fuels,” she said.

The report identifies significant fossil fuel investments and underwriting by Canadian companies. Among the examples are Fairfax Financial, which insurance market intelligence firm Insuramore ranks as one of the world’s top carriers of coal insurance, in part because its subsidiary Allied World “is a coal insurer of last resort” involved in several coal-fired power projects across Vietnam, Indonesia and the Philippines.

The Insurance Bureau of Canada (IBC) called the report "an inaccurate picture of the considerations related to climate change-related risk management."

Canadian "insurers operate in a competitive marketplace, which allows them to make their own strategic investing and underwriting decisions," IBC spokesperson Brett Weltman said in a statement. "While one company may decide not to underwrite a certain type of risk, others may choose to assume it as part of their business strategy."

Climbing rates

Last year was the second straight year of insurance claims surpassing $3 billion, and to maintain profitability, insurance companies hiked rates. According to the report, over the past decade, home and mortgage insurance rates have grown 73 per cent (36 per cent when adjusted for inflation), with an average 7.7 per cent increase last year, contributing to the cost of living crisis for both homeowners and renters.

Historically, high insurance payouts stem from a single catastrophic event like 2016’s Fort McMurray wildfire or 1998’s severe ice storm that struck Ontario, Quebec, New Brunswick and Nova Scotia. But as the climate crisis worsens, destructive weather becomes more common.

Last year alone Canadians witnessed the Okanagan and Shuswap fires (costing $720 million in insured damages); the worst ice storm in Ontario and Quebec since 1998 ($330 million); severe storms and flash floods hitting Ontario in the summer ($340 million); and more than 70 per cent of the population of the Northwest Territories evacuated as fires ripped through the region, destroying many properties.

This year has already seen $180 million in damages caused by a deep freeze in January, thousands evacuated from Fort Nelson due to fire risk, and the country is bracing for what experts say will be an above-average hurricane season.

Thanks to climate change, the Canadian Climate Institute estimates flood damage could reach $13.6 billion annually –– a tenfold increase –– by the end of the century.

“As these events get worse and worse, it is possible that insurers won’t consider them accidents anymore…As soon as these weather events tilt over from being accidents to being predictable, then they’re not really insurable,” Craig Stewart, vice-president of the Insurance Bureau of Canada, told CityNews last year.

Insurance premiums have increased faster than inflation, contributing to the affordability crisis, and at the same time rates are climbing, the insurance industry has increased its payout to shareholders, Taylor said. The report notes Fairfax Financial increased its annual dividend by 50 per cent in 2023, while Canada’s largest insurer, Intact, raised shareholder dividends by 10 per cent.

Lower-income families are most vulnerable, as they are forced to choose between insurance and essentials, Taylor told Canada’s National Observer. In the past five years, there have been more than 10,000 crowdfunding campaigns related to severe weather from individuals lacking adequate insurance, she noted.

Beyond hiking insurance rates, companies are also withdrawing coverage altogether in the face of increased climate risk. According to the report, more than 1.5 million households now lack affordable flood coverage, and an estimated six to 10 per cent of homes are currently uninsurable against flooding.

In February, Dejardins withdrew mortgage insurance for homes with a five per cent or higher chance of flooding, resulting in thousands of homes losing coverage. Last year, fire insurance in Kamloops doubled, and home insurance in Carleton Place, Ontario, nearly doubled.

Taylor pointed to insurers pulling out of some areas in Florida and California due to wildfires and flooding as “a scary taste of what’s to come in Canada.”

As insurers retreat, governments are stepping in. Since 2019, Canada’s insurance industry has lobbied for a national flood insurance program – essentially a way for governments to provide insurance to at-risk areas by backstopping private insurance companies. Budget 2024 earmarked $15 million to develop a national flood reinsurance program (providing government-backed insurance for insurance companies) to be launched next year.

Insurance Bureau spokesperson Weltman characterized the program as an example of industry and government partnering "to shift the financial cost away from taxpayers with a flood insurance program delivered by the industry on a not-for-profit basis."

At the same time as a national flood insurance program is being developed, federal disaster financial assistance arrangements (DFAA) are used to bail out people who lack insurance. Since 1970 when the DFAA was launched, over $8.5 billion has been paid out, with 62 per cent of that funding occurring in the last decade, according to the report.

“Overall, as climate impacts increase, the Canadian [property and casualty] insurance industry is seeking to pass along risk to taxpayers in the form of government programs for high risk properties, and in the form of an overall federal backstop,” according to the report. “This may increase the financial health of the industry in the short term, but threatens the industry in the longer term by potentially shrinking the size of the private insurance market, as we see today in places like Florida and California.”

Comments