Support strong Canadian climate journalism for 2025

In a dim, drafty room in Glasgow, the world’s most powerful bankers gather to unveil how they plan to save the planet. An ominous video plays: Earth, spinning in space, is paired with dramatic footage of sea waves crashing, busy highways and smokestacks spewing vile pollution to the skies. An alarm clock tick, tick, ticks underneath it all until the screen goes black and it rings, screeching across the hall. Flashed across the screen is the reason they’re in the room: “It’s time to finance our future.”

As the lights go up, heavy hitters from the international finance world take the stage for a momentous announcement. The world’s most powerful financial institutions are banding together to help pay for the transition away from planet-warming fossil fuels — a global alliance that could change the game on climate action. Standing at a podium emblazoned with the United Nations’ climate conference logo, Financial Times reporter Gillian Tett calls the meeting “quite striking” — this isn’t like previous climate conferences, dominated by heads of government and their environment ministers. This year, she says, “the money men and money women are in town.”

Arguably the most important “money man” in the room is former Bank of Canada governor Mark Carney. As UN special envoy on climate action and finance, he steers the massive global banking alliance that’s billed as the answer to climate action’s money problems. When he speaks, he’s frank about the way financiers think about climate action — a nice-to-have, but not essential. That’s why, he suggests, the world has been so slow to follow through on its climate goals. But that changes today, Carney says. “Right here, right now, is where private finance draws the line.”

That was last November. Rubber, meet road.

Since Carney’s line in the sand, the concept of sustainable finance is collapsing under the weight of its own hypocrisy. The biggest banks in this international club — including Canada’s major financial institutions — have sunk billions into new fossil fuel projects, growing the industry most responsible for climate change. A sustainable fund launched last year at the same UN climate conference is falling apart because the financial firms behind it failed to put up the money they promised. Wall Street is in revolt over new climate rules and the European Union is classifying methane gas as “green” for investment purposes. In May, Stuart Kirk, the head of responsible investing at HSBC, gave a speech to a room full of bankers arguing climate change wasn’t that big a deal. “Who cares if Miami is six metres underwater in 100 years?” he told his audience. “Amsterdam has been six metres underwater for ages and that’s a really nice place.” (After public outcry, he was suspended from his job.)

But the UN is not giving up so easily. In June, its Race to Zero campaign — which, through a series of alliances, includes Canada’s largest banks — updated its criteria for membership to make it explicitly clear: the energy transition means giving up fossil fuels. To remain in the club, save themselves from public embarrassment and stay competitive in a global economy moving away from coal, oil and gas, those banks — RBC, Scotiabank, TD, BMO and CIBC — now have until next summer to figure out how they plan to end financing for new fossil fuel projects. A tall order, considering they gave $24 billion to new fossil fuel projects last year alone.

With the clock ticking, will Canada's banks get their act together on climate — and who are the money men and women tasked with making it happen?

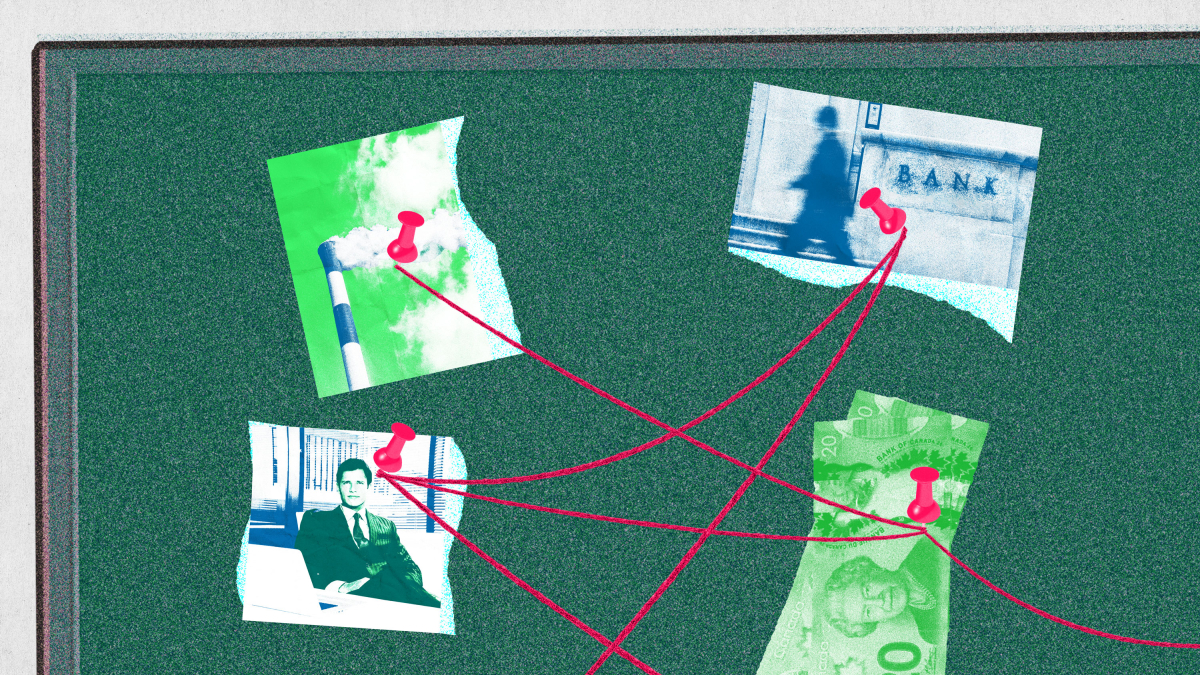

The answer reveals deep connections between Canada’s largest banks and the fossil fuel industry that pose significant barriers to climate action. To understand how a bank’s board of directors is influenced, Canada’s National Observer combed through the directors of Canada’s five largest banks — RBC, TD, Scotiabank, BMO and CIBC — and found one in five also serves on the board of a fossil fuel company, the industry most responsible for driving climate change. Thirteen of 63 bank directors have direct fossil fuel connections, the findings reveal, with at least one fossil-linked director serving on each of the Big 5 banks’ boards.

Practically, these connections mean fossil-linked directors must act in the best interests of both a bank and a fossil fuel company at precisely the same time the world must transition away from fossil fuels to protect the planet.

Serving on multiple boards at a time is entirely legal, and most bank directors are affiliated with more than one company. Canada’s top financial executives have connections to a range of industries, with directors also serving on the boards of companies like Bell, Air Canada, McKinsey & Company, Goldman Sachs and others. But zoom out to include connections to pension funds and investment firms that own coal, oil or gas infrastructure, chemical firms that use fossil fuels or utilities that burn coal, and the number of fossil-linked directors grows, though how much is not entirely clear because the full extent of investments for some companies, like asset managers, is not publicly available.

Canada’s National Observer contacted all five of Canada’s largest banks for this story. None of them returned repeated requests for comment.

These connections raise questions about what the most powerful people on Bay Street are doing to take on climate change. Directors aren’t responsible for handling specific loans or investments — in fact, they don’t manage any of a bank’s day-to-day operations — but they are responsible for setting a bank’s overall strategy, including how it plans to deal with climate change. For some, this raises questions about whether directors with fossil fuel interests have a place in the boardroom.

Rosa Galvez argues they don’t. The Independent senator from Quebec and former Laval University professor has long been interested in the environment. When she was in grade school, the first assignment she chose for herself was about pollution in Mexico City. That interest has carried through her career, with much of her academic research related to pollution. As a senator, she tabled a bill earlier this year calling for Canada’s financial sector to fall in line with the country’s climate goals. The Climate Aligned Finance Act is a long way from becoming law, but it offers several suggestions on how to make the financial sector line up with Canada’s climate ambitions.

Getting rid of bank directors whose financial interests aren’t aligned with the country’s climate commitments — like someone who sits on a bank board and owns stock in a fossil fuel company hoping to produce more oil — is one recommendation. You wouldn’t put the director of a cigarette company in charge of public health, Galvez argues, so why let a fossil fuel exec weigh in on a bank’s climate policy?

There’s a clear parallel to Big Tobacco, she says. Almost 20 years ago, the World Health Organization launched a treaty to bring down tobacco use. Nearly 200 countries signed on, recognizing that governments had to protect public health decisions “from commercial and other vested interests of the tobacco industry” because what was best for the tobacco industry and what was best for public health were fundamentally at odds.

“Now it's exactly the same situation with fossil fuels,” said Galvez. We shouldn’t be asking the fossil fuel industry to weigh in on climate goals for that very reason, she says, but with “their presence in the boards, that's what they're doing.”

Exactly how influential fossil fuel directors are on bank boards is not always clear. RBC is the largest financier of fossil fuels in Canada — and fifth largest in the world — but only has one fossil-linked director. BMO, meanwhile, is the only major Canadian bank that’s promised to lower its total greenhouse gas emissions by 2030, and it counts two fossil-linked directors on its board. TD lists four directors with ties to fossil fuels and was the No. 2 financier of oilsands expansion last year, pumping $6.8 billion into the sector.

Because the Big 5 banks are among each other’s largest shareholders and are all major shareholders of oilsands companies, these fossil fuel connections on their boards represent yet another way Canada’s major financial powers move in lockstep and favour the energy systems we already have — ones that create huge amounts of planet-warming greenhouse gas emissions. It’s one of the reasons why Canadian banks have been repeatedly called an “oligopoly” in the business pages of the Globe and Mail, and companies like Enbridge, TC Energy, Suncor, Shell and Teck have all received billions of dollars over the past seven years, allowing them to produce more fossil fuels.

Ultimately, the way banks navigate the world’s transition away from fossil fuels is based on how quickly the directors expect the energy transition to unfold. That’s what makes the overlaps between the financial and fossil fuel sectors important: many banks see a slow transition as a safer way to earn back their investments, while a rapid transition would mean writing down the value of those assets. No bank wants to take losses it could avoid, but the science is clear: the more the planet warms, the more damage is locked in and the more other investments — like mortgages on properties built on floodplains — are threatened by a worsening climate.

However the transition to renewable energy plays out, both finance and fossil fuels are in for some major changes. Oil prices are sky-high right now, and governments like Canada’s are greenlighting new fossil fuel projects. This may mean barrels of money in the short term, but as the world moves away from dirty energy sources — the way climate science requires — those investments risk becoming worthless as demand for coal, oil and gas evaporates.

Carol Liao, director of the Centre for Business Law at the University of British Columbia’s Allard School of Law, told Canada’s National Observer that directors who sit on both a bank and fossil fuel company’s board have to be very aware of potential conflicts of interest while following their legal duties to act in the companies’ best long-term interest. If they were in conflict, a director couldn’t be acting in the best interest of one company one day, and another the next.

“You can’t just put on different hats when you want,” she said.

Liao said directors should recognize we’re in a climate emergency that will fundamentally change the way we use energy, and in that context, ask themselves what their recommendation to the company should be.

“To me, it's not: Lobby the government to continue,” she said. “It's how can I transition to be part of this movement so that I can have longevity.”

From this perspective, banks must shift their money into renewable energy and away from fossil fuels. This will be a major challenge for the Big 5, which have loaned or invested over $900 billion in fossil fuels since 2015.

For fossil fuel companies, the only way to survive a transition that requires keeping their main moneymaker in the ground is by opening up new lines of business, like solar or wind, and phasing out their fossil fuel production in line with what the atmosphere can handle.

That transition is happening, but not nearly fast enough. According to the International Energy Agency (IEA), clean energy investments grew about two per cent from 2015 to 2020 but have since exploded, growing 12 per cent. However, that progress could be cancelled out by the 10 per cent growth in coal investments, pushing the IEA to say fossil fuel spending is “caught between two visions of the future.”

Informed or clouded decision-making?

Because planning for climate change falls squarely with a bank’s board of directors, advocates say a director’s legal obligation to look out for both a bank and a fossil fuel company makes it more difficult for them to craft credible climate strategies.

Environmental Defence’s senior manager for climate finance Julie Segal says there needs to be a clear understanding of not only climate change but how finance intersects with the natural world. Directors are responsible for identifying what risks and opportunities are important for a company. Understanding how their business affects the environment and how the environment will affect their business is crucial.

Long before she began a career in climate finance, Segal understood this. She remembers being in her elementary school geography class and stumbling across a critical piece of information about the Amazon rainforest: even in economic terms, the land is worth more left standing than it would be as a pasture for cows or a soybean farm.

“As a 10-year-old, or however old I was, I was euphoric… If only people knew this data — it's worth more as is rather than grazed — we're going to save the rainforest,” she recalled.

As Segal readily concedes, saving ecosystems is not as simple as presenting the right information and counting on others to see the same logic. Many climate scientists now understand that, too, and are bumping up against a grim prospect: they can refine their models all they like, but at this point, we know climate change is happening and we know it’s a crisis that will only get worse. The ball is out of their court; it’s on those with power and resources to change course.

For financial institutions that have a vital role to play in financing the energy transition, “having a conflict of interest in (bank director) appointments clouds decisions because it creates a bias,” said Segal. “It creates a bias toward the status quo energy situation, which clouds what's supposed to be clear-eyed decisions from the board.”

Not everyone sees it this way. Because banks play such a central role in the economy, they want representatives from all major sectors on their boards to help inform decision-making. Moreover, some argue that by having connections to fossil fuels, banks can use their influence to encourage greener performance.

“I don't see it as being a problem,” said Carol Hansell, an internationally recognized expert in board governance. A senior partner with Hansell McLaughlin Advisory Group, a firm specializing in board governance and strategy issues, Hansell literally wrote the book on what directors need to know. “The fact that they're knowledgeable about the energy sector is only a positive thing for the bank,” she added, because it brings expertise to the board about how a major sector of the economy works. Similarly, on a fossil fuel board, the director who also sits on a bank’s board would bring expertise from the financial sector to help the company set its strategy.

“I would not criticize a board for having somebody from the fossil fuel sector on their board. There's lots that that experience will help them contribute, including how the organization is responding to the very real threat to their business of people saying, ‘Look, you should just be phased out,’” she said.

Those calls to phase out the industry are growing louder by the day. It’s not just environmentalists and climate scientists pushing for this essential step in the fight against climate change. United Nations Secretary-General António Guterres recently said the fossil fuel industry and its financiers “have humanity by the throat.”

Critics say the fossil fuel industry is unlike any other because burning fossil fuels is the leading driver of climate change. Therefore, they argue, it should be treated differently.

“There are no other industries which actually create existential systemic risk for society and for the bank this person would be sitting on the board of,” said Segal. “That would create a very real challenge for this individual who’s sitting on the boards of both types of companies because they're quite literally pulled between fundamentally opposing business models.”

Like the energy translation itself, untangling the relationship between fossil fuels and finance won’t happen overnight. Galvez’s bill would require banks to publicly disclose fossil-connected directors for the first three years after the legislation came into force, and then ban those directors from serving on a bank board from the fourth year on.

Despite being tabled in March, Finance Canada does not yet have a public position on Galvez’s bill. The department told Canada’s National Observer it will “communicate its position in due course.”

While legislation tabled in either the Senate or House can become law, generally the House is where the action is. For those not closely watching Parliament Hill, the Climate Aligned Finance Act being tabled in the Senate may seem like an atypical path, but the upper chamber has changed from its days of being a “sober second thought” of partisan, unelected officials, says Segal.

“There was a really important shift when the Independent Senators Group was created and when the format of the Senate changed into a majority non-partisan body because it leaves more space for innovation rather than just being the sober second thought it initially was,” Segal said. “I would say that (Galvez’s bill) is almost a first step — a seminal event — in showing that interesting policy innovations can come from the Senate.”

Further, by having legislation drafted by Parliament Hill lawyers, officially translated and, ideally, debated and refined by the Senate, Segal says it makes it much more efficient for an elected member of Parliament to bring it to the House.

“With all of this pre-work done, it's first of all more advanced in the conversation, where this has helped open and move the Overton window, but it also will take less time to move it forward with a lot of this work having been done already,” she said.

Regardless of whether the legislation is in the House or the Senate, Segal says it’s crucial to recognize that aligning financial institutions with climate goals is vital for Canada to meet its international commitments.

“This is coming through in the Senate because it's necessary, and the elected officials in the House are failing us to move something forward that's strong enough to bring the financial sector aligned with Canada's climate commitments,” she said.

“So this is important because it's filing a regulatory void.”

Comments

Good article. What's happening now with this turbine is a good example of how tangled everything is and therefore how difficult. I heard a woman minister (international trade? not sure) succinctly point out that there was little value in Germans being unable to heat their homes this winter.

Trudeau acknowledges the difficulty of the decision and obviously REALLY doesn't like slipping in Zalensky's (and the world's eyes; try to imagine even being in that position) but this woman said it best. Germany is a true leader in trying to walk the walk on climate change after all, but is faced with using more coal at this point after shutting down its nuclear, which is just where we all are right now.

As far as the Senate having changed its role in all this, and to the extent that it can actually have influence, Trudeau does deserve credit for that.

I would strongly argue that the turbines should not be returned to Russia, and that doing so violates the spirit and letter of the sanctions against Putin for waging his war and fostering crimes against humanity. Returning the turbines elevates German comfort over Ukrainian lives, namely the murdered innocent civilians who were never mentioned in this ill-advised decision. The cities that were flattened by remote missile launches as a "legitimate" form of warfare were never addressed either. Ukraine is rightfully now taking Canada to court. What an embarrassment.

Moreover, it was a shameful act, especially to the two+ million Ukrainian Canadians who are insulted by Trudeau's hypocritical two-faced antics, one day hugging President Zelensky for the cameras and breathlessly announcing a few more dribbles of military help, and then turning around to give Putin two great big gifts: the means to continue financing the deaths of tens of thousands of Ukrainians while grabbing their sovereign land; and proving him right by watching Trudeau divide Western allies and NATO and greatly erode the sanctions. Trudeau is now a diminished leader in their eyes.

The revenue from Russian gas sales to Germany enabled by these turbines will prolong the war only because Germans can continue to dither on breaking its too-dumb-for-words dependency on Russian gas and oil and transitioning to renewables to an extent that has infuriated its neighbours. The leaders of Germany, France and Italy and some individuals in NATO management seem only too willing to allow Ukrainian lives and territory to be sacrificed (and to avoid "embarrassing" Putin by sending realistic supplies of weapons) in order to not face down their own energy stupidity and risk having their tender tootsies frozen next winter. I can guarantee their narrative would be completely different if Milan, Marseille, or Munich suffered the same fate as Mariupol -- bombed into dust saturated with blood.

Those who sympathize with the German "plight" should send them containers of wool socks. As a descendent of both Ukrainians and Germans, I prefer to continue to send donations for humanitarian assistance to Ukraine through the Red Cross and Doctors Without Borders. My attitude has shifted to 'F*ck Trudeau' on this issue, but not by any means in the same context as the delusional trucker convoy.

Annalena Baerbock, German Green Party leader, minister of Foreign Affairs and primary backer of Olaf Scholz's Chancellorship in their coalition government, diverges 180 degrees from Scholz by promoting the rapid escalation of shipping precision Western weapons to Ukraine under reasonable conditions, mainly so that Ukraine can defeat Russia (that is possible, given their determination and notable successes to slow the advancement of an enemy several times larger) and speed the shutting down of Nord Stream One, the very trunk gas main these turbines came from. Shutting down Russian gas and oil deliveries will catalyze the transition to renewables in Green minds, and they are willing to suffer some cold extremities and blackouts next winter to do it.

Italy, despite its two-faced comments on giving up the Donbas, the Sea of Azov and Crimea for "peace" (which will only give Putin permission to eventually expand the war to Moldova and beyond), also initiated a program that will see the Italian government pay 100% of the cost -- plus a bonus -- for exchanging all domestic gas furnaces and boilers to electric heat pumps, geothermal systems and renewable electricity generation. Now that is a policy all Western nations can embrace. But not, it seems, Germany or Canada on the climate file.

The great irony is that Putin will now have additional bankable revenue from gas sales not just to wage a longer war, but that will also cushion the blow to Russia's revenue stream from purposely shutting off gas supplies to Germany anyway, just as a cold front moves in on Europe next winter. Avoiding the transition today could have huge consequences a few months from now. The cost of dithering is often higher than acting boldly.

The fundamental idea set out in this article, which also underlies Senator Galvez' bill and commentary by Julie Segal, is that there is a conflict between sitting on a bank board and a fossil fuel board. That is invalid: The business case for transition rests on the same facts and assumptions for both finance and the fossil fuel industry. The time horizon is key to whether the business case is for or against transition and its speed -- in both industries. Where the drivers of change are to be found is the strategic issue. Mark Carney is trying.

I can think of nothing more normal and expected than that banks heavily invested in an industry would want to have representatives of that industry on their Board.

Instead of conflict of interest, think leverage.

"I can think of nothing more normal and expected than that banks heavily invested in an industry would want to have representatives of that industry on their Board."

Or is it more like, the banks have representatives of the industry sitting on their boards and therefore heavily invested in the industry?

Any count of how many environmental representatives sit on the board of our Canadian banks?

"Instead of conflict of interest, think leverage"

Well, that's certainly the "glass half full" view.

Unfortunately, the future of the fossil fuel industry doesn't look rosy; so what, in fact, will such leverage accomplish? Move their money into a chain of lingerie shops, perhaps?

Board incest, let's call it, has been a problem likely from the moment boards were created. There was an article I read, (>20?) years ago, in an American publication which had a great chart of board-level inter-linkages in corporate America. It's telling. At the corporate level of self-interest, it is useful to link the corporate Borg; less so at the societal level (though they would disagree because "society is best served by what is best for corporations").

John Woodside's columns are one of the few reasons I maintain my National Observer subscription. An exemplary piece.

I have Mark Carney's book 'Value(s)', which sits only half read on a shelf. It's rather dense, but my impression is that Carney is an honest broker not very susceptible to political rhetoric or ideology. My view is changing, in that I have lost faith in politicians to do the right thing on climate. It's up to consumers and scientists to change the direction of banks, corporations and governments, which is a tall order because dependency on fossil fuels has many layers that penetrate deeply into society.

Vaclav Smil, Professor emeritus at the University of Manitoba, would probably argue that the transition is hard from a view that concentrates on the laws of physics mainly because carbon dependency, which is often out of sight, represents the high energy density of fossil fuels which is hard to replace with renewables at a 1:1 ratio. I concluded long ago that society needs to permit the shrinkage of our energy consumption by probably up to a third. Enter public transit and better quality urbanism over car dependency and sprawl. EVs will never attain the numbers needed to displace 100% of the car population due to the use of critical, expensive materials and enough power supply, but that is not to say the remaining land transport vehicles should not transition to EVs as household and business budgets permit.

I think there is too much focus on individual initiatives like EVs -- almost like an obsession -- when our entire society needs to take a Critical Thinking Pill and adopt a more holistic view and redefine its priorities. Critics have a very important role to play, but they also need to question the naïveté so often espoused in media and online about easily transitioning off carbon and get to know the realistic basics about thermodynamics and economy.

A National Transition Plan (NTP) will be exceedingly difficult and expensive. If a politico decides to promote an NTP but underfinances it, it will fail. You cannot build an electric high speed rail network without building tunnels and overpasses to eliminate level crossings. PV panels may be cheap but they work at only 25% energy efficiency compared to gas turbine power plants. Policy that results in the loss of 100,000 jobs in the oil industry is unworkable unless it also creates 100,000 new jobs of relatively equal value in renewables, hopefully in the same region. Financing massive oil sands projects will ignore the cacophony of criticism until such time as money changes the conversation through shifting consumer demand toward private sector innovations (e.g. cheap econobox EVs) and increased carbon taxes.