Support strong Canadian climate journalism for 2025

Ah, 2012: A time when the world seemed to belong to Canada. Foreign money flooded in, with capital spending in the oil and gas sector at $60 billion and the Canadian dollar — now a petrodollar — on par with the U.S. Pipeline projects were proposed willy-nilly: Keystone XL, 830,000 barrels per day(KBD); Energy East, 1.1 million barrels per day (MBD); and Northern Gateway, 525 KBD. We believed they were all needed because we imagined the oilsands would just get bigger and bigger.

In that year and environment, Kinder Morgan proposed what seemed to be a visionary project, TMX, to triple its Trans Mountain pipeline capacity by an additional 590 KBD for a paltry $5-billion price tag. Costs to build TMX have now ballooned to $30 billion.

Since then, all except the TMX project has been abandoned and we’re repeatedly told this has been an economic disaster for Canada. Isn’t that what our prime minister said when he bought Trans Mountain in 2018? “The Trans Mountain pipeline expansion is a vital strategic interest to Canada. It will be built.” That’s been the narrative, but none of it has turned out to be true.

Let’s look at the facts. The forecast in the National Energy Board (NEB)’s 2011 report “Canada’s Energy Future” predicted 2022 Canadian oil production would be at 4.8 MBD, assuming the necessary pipelines would be available. Since none of those pipelines were in place when 2022 rolled around, we should have expected to see a huge drop in the growth of oil production, right? Nope. We’ve seen our oil production grow by almost two-thirds from 2011, from 3.1 MBD to 5.1 MBD in 2022, handily beating that forecast.

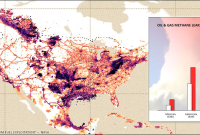

How is that possible? That growth was managed because the pipeline network already in place was expanded to points deep into the U.S., extending all the way into Texas and Louisiana for shipping to points beyond. This growth was through the efforts of Enbridge and TC Energy, which say there are yet more opportunities to expand.

You might say: But what about those new markets TMX is going to serve, like China? That’s not a problem that needs solving; our crude is already going there. In the U.S., the tight oil fracking revolution happened with cheaper, better-quality oil than the oilsands closer to markets. And there was so much of the stuff that the U.S. authorized exports of crude offshore. As a result, there has been a massive build of export terminals on the U.S. Gulf Coast and our crude oil is finding its way to overseas markets through those facilities.

According to RBN Energy, more than 300 KBD of Canadian crude made its way to China, India and Spain through the Gulf Coast in March 2023 alone. The Gulf Coast route also has a freight cost advantage over Vancouver because it can accommodate larger ships.

What about the future? Well, that’s where we see how truly terrible it is to build TMX. Let’s set aside the fact that all the smart money has fled Alberta for the more attractive U.S. tight oil fracking plays and instead look at the NEB’s successor agency’s production forecast.

According to the recent Canadian Energy Regulator forecast “Canada’s Energy Future 2023,” our crude production will peak at 5.7 MBD in 2027 and begin a long decline to only 1.3 MBD in 2050, driven by a drop in world crude prices. This is based on a global net-zero scenario per the Paris Agreement goals. (Of note, crude production growth between 2022 and 2027 includes 50 per cent light crude and diluent, which are unlikely to move through TMX).

This is the environment the Trudeau government will face when it starts up its new pipeline. There isn’t enough crude today to fill both TMX and the current system, and there will be even less in the future if the net-zero world unfolds. All TMX will do is rob barrels of oil out of the existing pipeline structure to the U.S., which is functioning well and still has room to expand.

TMX is destined to be a white elephant monstrosity built by our government.

The capital on this unneeded pipeline has ballooned to $30 billion and it is impossible to charge enough on tolls to recoup the cost. The heavily subsidized toll being proposed is about one-half what it should be and is being challenged by the shippers for being too high. They are asking for even larger subsidies from the Trudeau government.

The Trudeau subsidies for fossil fuel shippers on the TMX pipeline, who have firm contracts forcing them to pay whether they ship or not, seriously disadvantages unsubsidized shippers on the Enbridge crude mainline, where there are no firm contracts for shipping. Enbridge is certain to lose business when TMX starts up and then when world demand for oil drops.

TMX is truly a lose-lose project. Its only chance of success is if the world fails to shift to clean energy and global net zero doesn’t happen, which will have far worse repercussions than just Trudeau’s really, really bad pipeline decision.

A terrible idea just gets more terrible no matter how you look at it.

Comments

Ford building gas plants, Smith polarization, Moe a divided province, Quebec an insular province, all costing many billions and not needed. As well as costing their respective economies and Societies many billions. TMX built as an appeasement to Alberta but failed royaly

Trudeau talks the talk about climate change, but his actions speak louder than words. Just wait, none of the climate targets will get met, it is just the same old, same old with our politicians. Conservative premiers will undermine everything related to climate change if it helps their oil & gas buddies who support the party with generous political donations. Canada has become the climate change joke of the world.

And yet nowhere in your article do you mention the absolute pandemonium going on in Alberta, with the Conservatives demanding it be built because otherwise the whole world, especially Trudeau was against them and their very valuable industry who of course had footed the bill for all of Canada! You forget the insanity of the turncoat NDP leader who demanded that pipeline be built, spent a fortune putting up billboards in BC and threatened BC with all manner of legal proceedings if we didn’t let it be built across OUR province.

And all the rantings and ravings from the other prairie oil producers, whining and snivelling

about their “desperate” NEED for that pipeline so they could sell to China!

This was a PM trying to make peace. Absolutely a stupid way to do it, and to keep building it when all estimates of price continued to skyrocket, but a PM nonetheless, who did what he did to make Alberta shut TF up.

But of course we all now know that NOTHING will stop the incessant whining, moan and groaning about how hard done by they are and that no one has EVER done anything for Alberta!

I certainly share your frustration at the false narratives driving bad political decisions and worse environmental policy, it's one of the reasons I keep writing. I wrote that specific piece 4 years ago. https://www.nationalobserver.com/2019/05/17/opinion/myth-anti-alberta-l… and this piece a year ago....https://www.nationalobserver.com/2022/10/06/opinion/trudeau-fossil-fuel… and many pieces published elsewhere like this one from 2016 "Trudeau says we need Trans Mountain. What if he's wrong?" At least 7 years writing about how bad this idea was, and as I said in this piece it just keeps getting worse.

Many kudos Ross.

Very well said Alexis.

As a meteorologist, I know how hard it is to forecast the future. It appears that buying TMX and expanding it will be a big mistake; of course, we will not know that for sure before several more years.

So, if that big underground pipe turns out not to be needed to carry oil, what could be done with it? Could it carry water; electricity? I think that its time to look for ways to minimize our losses, even to do something even better than initially anticipated.

You don't need a massive pipeline to carry electricity. I suppose you could shove wires through it if it was empty, why not, but you sure wouldn't be getting $30 billion of benefits from that. As to water, if there's one thing we don't want it's to be shipping masses of water around via pipelines. I'm sure the Americans would like pipelines full of our water; giving it to them would be a terrible mistake.

As a meteorologist, your problem seems to be that you know what the parameters and boundaries are in meteorology, the nature of the problem space, but not in other areas. So you might not know what the weather will be tomorrow, but you know that the barometric pressure will not decline to zero because there's still going to be air up there, and anyone who claims otherwise is ignorant of some basic facts. But in other fields you might not know what things are unpredictable weather possibilities, and what things are outside that zone.

So, on whether buying TMX and expanding it will be a big mistake--it is not a CERTAINTY at 100%, no. But I'd say we're definitely in the 99% range. So in the philosophical sense we probably KNOW it is the case in the sense of having a justified, true belief that it is the case. I know this problem space pretty well, and most of the unexpected events that could happen would cause net declines in demand, not increases. I suppose a major war in the Middle East that included Iran could close the Strait of Hormuz--but even that would be temporary, not enough to make the pipeline profitable over time. To not be a white elephant, that pipeline has to be fully used with high fees for decades. We can't predict the future in detail, but that pipeline being profitable is outside the variations that are plausible, starting to get into "barometric pressure declines to zero" territory.

There is one thing that might make it profitable for a while in maybe the 30s if electric vehicles don't take over as much as I'm pretty sure they will: Fracking is a very short term thing, and they could run out of frackable oil. But I think oil demand will actually start declining somewhat faster than the IEA predicts, and even fracking hitting a quite sudden decline would probably not be enough to make this pipeline profitable.

Cities can make potable water very cheaply; water treatment really scales. But they can only sell it to towns so far away, because pumping costs for water make it expensive water in just a few hundred km.

People will pay for drinking water, but irrigation water, almost nothing, as "Chinatown" explained.

Excellent article. However, economist Robyn Alan said much the same years ago, including documenting the excess capacity of existing pipes and the lack of Asian buyers specifically for low quality bitumen with some diluent in it.

The article doesn't specify, but my guess is Canadian dilbit entering the US via pipe is no longer dilbit when exported from the Gulf Coast. The majority of it is probably refined into at least usable synthetic crude, more likely further refined into high value products like gasoline and diesel.

In other words, most of the real value is captured by American refineries after nearly 80% of Canadian oil extraction is accomplished by foreign owned companies, predominantly American. This has been the Canadian Way since the 1700s over timber, fish and fur.

Didn't Trudeau once say the profits from TMX will be used to fund renewables? That comment was naive then, but now seems downright stupid and vacuous.

I suppose it's true in a weird mathematical sense. The negative profits from TMX will be used to fund negative amounts of renewables; because of it we will end up with less renewables than we would have had.