Support strong Canadian climate journalism for 2025

Canada’s Opposition leader, Pierre Poilievre, has repeatedly attacked our national carbon tax-with-rebate policy. This policy places a rising fee on many sources of climate pollution, including the emissions from burning gasoline. That’s the “tax” part. The “rebate” part is cheques sent to Canadians that more than cover the costs for about 80 per cent of families.

Recently, Mr. Poilievre expanded his “axe the carbon tax” campaign to include all federal taxes on gasoline. He claims Canadians are overburdened by such “radical, wacko” policies and has called for a “gas tax holiday” in which all federal gas taxes are suspended.

Are Canadians paying crazy-high gasoline taxes?

Here’s a series of charts on the topic. Take a look and decide for yourself.

What do our international peers pay?

Let’s start by looking at what others pay in gasoline taxes across the three dozen nations of the Organisation for Economic Co-operation and Development (OECD).

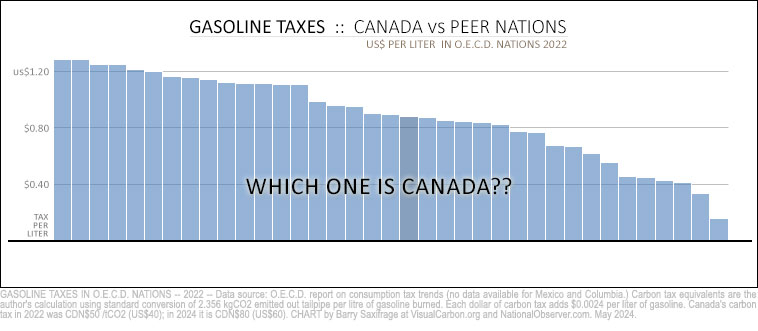

On my first chart below, each nation has a blue bar that shows the size of their gasoline tax. Can you guess which one is Canada?

If you picked the third-smallest bar, you’re right.

Hey, every day is a gas tax holiday in Canada.

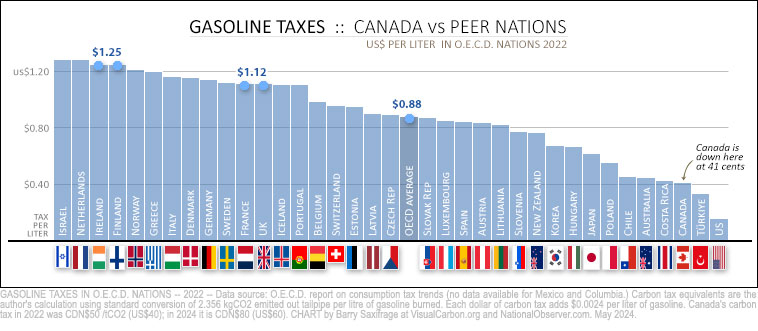

Below is the same chart with all the country names added on, plus some highlighted prices.

Canada’s gasoline tax is the third smallest in the group at $0.41 per liter. (Note: This chart shows 2022 gas tax rates in US dollars, which is the most recent data available from the OECD.)

You can easily see how little we tax ourselves compared to most of our international peers. That’s like giving ourselves a big gas tax holiday every day in Canada.

For example, we only tax ourselves half of the OECD average (dark blue bar) – that’s like a half-price sale all year round.

As the chart also shows, our Group of Seven (G7) peers in Germany, France and the United Kingdom tax themselves nearly triple what we do to burn gasoline – around $1.12 per liter.

And how about our oil-producing, cold-north-living, peers in Norway? They tax themselves $1.25 per liter. That works out to an extra Canadian dollar per liter above what we pay. Compared to them, we already give ourselves a permanent buck-a-liter gas tax holiday.

But, judging by the current ruckus in our country, at least some Canadians want to pay even less. And our federal gas taxes are apparently the problem.

So, let’s look at those next.

The Canadian breakdown

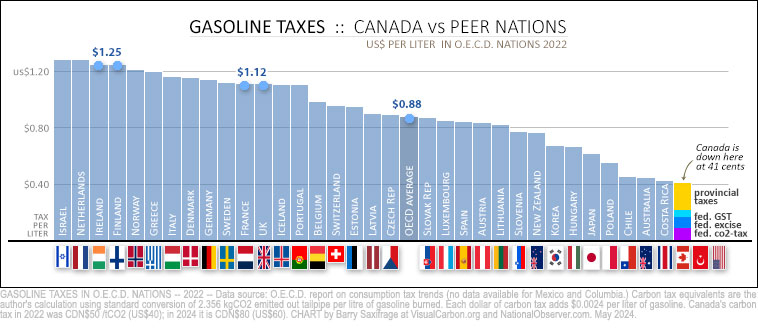

Canada’s gasoline tax can be broken down into four main parts. I’ve colour-coded them on the chart below.

The yellow bar at the top of Canada’s stack is provincial taxes. They make up around half our gasoline tax.

Three federal levies make up the rest: a five-percent GST (light blue); a ten-cent-per-liter excise tax (dark blue); and the biggest source of controversy, our national carbon tax-with-rebate (purple).

If you are having trouble seeing the purple bar, it’s because it is tiny compared to overall gas taxes in Canada and nearly every other nation. This tiny official carbon tax is like a garden hose fighting a megafire. Yes, it helps some, but it’s far too small to stop the town from burning down.

To help illustrate just how undersized Canada’s official carbon tax is, my next chart will let you compare it to the much larger “effective carbon tax” imposed on gasoline by most OECD nations.

Official vs effective carbon pricing

For readers that aren’t familiar with effective carbon pricing, here’s a quick overview. Economists point out that there are two types of carbon pricing on gasoline – explicit and implicit. Their combined total is referred to as the effective carbon price.

Explicit carbon pricing is based on carbon content — like Canada’s official carbon tax-with-rebate. In most nations, including Canada, the explicit carbon tax on gasoline is relatively small.

Implicit carbon pricing is imposed on drivers by other gasoline taxes, such as the excise tax. These other gasoline taxes aren’t based on carbon content. But they still increase the amount that drivers pay per tonne of CO2 they emit. In economic-speak, implicit carbon pricing raises the marginal cost of emissions. In most nations, the implicit carbon tax on gasoline is relatively large.

Drivers react to the combination of explicit and implicit carbon prices. That’s why many groups, including the OECD, focus on the overall effective carbon tax that governments impose on gasoline — and not just the explicit part.

Let’s now look at how they compare.

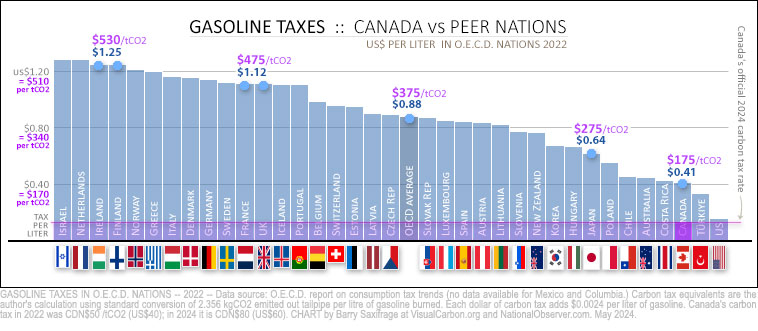

As discussed above, the effective carbon pricing on gasoline is set by the total gasoline tax. On this version of the chart, I’ve added purple numbers indicating the effective carbon pricing.

For example, the British gasoline tax is $1.12 per liter. That works out to $475 in tax per tonne of CO2 emitted. So, their effective carbon tax rate on gasoline is $475 per tonne of CO2. That’s a very big financial incentive for British drivers to emit less climate pollution out of their tailpipes. As we will see below, that’s what happens.

In contrast, Canada’s much lower overall gasoline tax imposes a much lower effective carbon tax on Canadian drivers — a whopping $300 less per tonne of CO2 emitted than what British drivers pay. So, it is not surprising that Canadians dump a lot more climate pollution out of our tailpipes.

Canada’s official (“explicit”) carbon tax rate is smaller still. I've shown this rate with a horizontal purple line on the chart. On April 1, our official carbon price rose to $80 per tonne of CO2 (US$60 on the chart). As you can see, our official carbon tax creates a very tiny price signal compared to the effective carbon price most governments put on gasoline.

The tailpipe super-emitters

It’s basic economics that if you make it cheaper to pollute, people will pollute more. To show how this plays out with gasoline taxes, I’ve added emissions from transportation to the chart. Specifically, each nation's red dot shows how much CO2 they emit per capita from transportation. The red line indicates the level of two tonnes of CO2 per capita.

On the left side of the chart, you can see that most nations with high gasoline taxes (i.e. high effective carbon pricing) emit around two tonnes per capita or less. The Netherlands have the highest gasoline tax in this group — and the lowest transportation emissions at just 1.5 tonnes per capita.

On the other side of the chart are nations that keep their gasoline taxes very low — and thus keep their effective carbon price for drivers very low as well. Here we find the tailpipe super-emitters, including Australia, Canada and the United States.

Canadians emit twice as much (4.3 tonnes of CO2) as our British, German and French peers. The Americans emit even more than we do: 5.3 tonnes per person. And look, Americans tax their gasoline even lower than we do.

Canada plans to continue raising its official carbon tax-and-rebate price. But not very much — only $0.19 per liter by 2030. Such a small increase would still leave our effective carbon price on tailpipe emissions far below today's OECD average. And we'd need to increase our official carbon price by hundreds of dollars more than planned per tonne of CO2 just to match the current incentives for most of our European peers.

Low gasoline taxes lock in climate failure

Low gasoline taxes lock in climate failure by encouraging people to buy hyper-polluting cars and discouraging them from switching to cleaner alternatives.

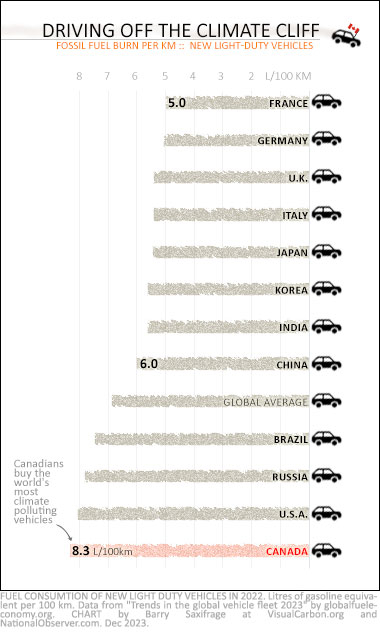

Our extremely low gasoline taxes are a major reason Canadians and Americans choose to buy the world’s most climate-polluting new cars.

New cars last for a decade or two. And our average new fossil fuel burner will dump 60 tonnes of CO2 from its tailpipe over those years. That locks in climate failure.

As this chart also shows, our British peers buy far cleaner new cars. A major reason is the additional $300 per tonne tax on tailpipe CO2. That means a British driver pays $18,000 more to fuel such a polluting car. Canadians would also buy cleaner cars and trucks if we taxed our pollution how they do.

How did British gasoline taxes get so high? Back in 1993 — yeah, 30 years ago — the Conservative U.K. government of John Major doubled Britain's gas tax in an effort to reduce climate pollution. He introduced his Fuel Duty Escalator policy, saying: “The largest contribution to the growth in United Kingdom carbon dioxide emissions in the coming years is expected to come from the transport sector… (this escalator will) provide a strong incentive for motorists to buy more fuel-efficient vehicles.”

We are now three decades deeper into the climate crisis and megafires, floods, droughts and superstorms have started to hammer away in earnest. The response from today's Canadian conservative politicians is to axe our relatively tiny gasoline tax in half.

What do you think?

Should Canadians make it even cheaper to pollute than we already have?

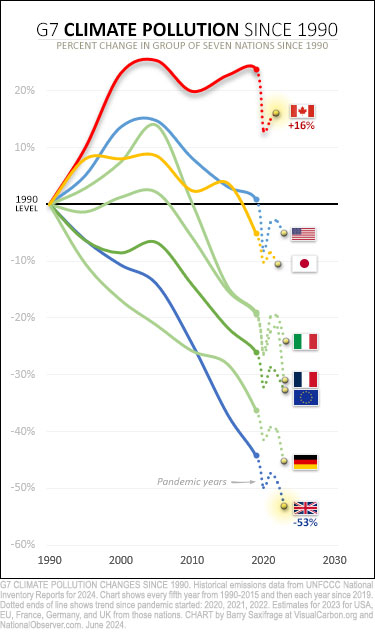

I’ll wrap up this article by stepping back to look at the bigger picture. My final chart shows what the G7 nations have done with their total climate pollution since 1990. This is based on the just released 2022 data from each nation (plus the 2023 numbers when available).

Canada is clearly the climate rogue in the group. We’re the only nation still emitting more than in 1990. A lot more.

Is this who we want to be as Canadians? Stuck high up on the crumbling climate cliff as our peers are far below on their way down to safety? If not, we need to burn a lot less gasoline and diesel — because producing and burning them has caused almost half our national emissions increase so far.

While we've been increasing our climate pollution, the Europeans have cut theirs by a third. Germany and the U.K. have done the hard work to cut their emissions in half. And both have reduced their transportation emissions along the way.

I hear our conservative politicians talk favourably about the need for cheaper motor fuel and a holiday from paying gasoline taxes.

What I don’t hear them talk about are the kind of cars and trucks that actually deliver these things to Canadians today — battery electric vehicles (BEVs).

Hundreds of thousands of Canadians already own a BEV. These BEV owners don’t pay gasoline taxes because they don't burn gasoline. Instead, they fuel up with much cheaper electricity produced right here in Canada. As a big bonus, BEV drivers aren’t forced to pump toxic air pollution and perpetual climate misery out of their tailpipes just to get around.

Axing Canada's carbon tax will increase climate pollution.

Switching to Canadian electricity for driving will cut climate pollution. And it will also save Canadian drivers far more money every time they fill up than any gas-tax-holiday ever will.

-----------------

ENDNOTES

How to calculate the relative cost and emissions of filling up with gasoline vs electricity

A general rule of thumb is that 2 kWh of electricity drives an EV as far as one liter of gasoline drives a gasoline-burning car. For an in-depth explanation on this, see here.

This handy 2-to-1 ratio can be used to quickly estimate both relative fuel costs and relative fuel emissions.

FUEL COSTS — In Vancouver, where Conservative leader Pierre Poilievre recently attacked pollution pricing, electricity costs $0.14 per kWh. The 2-to-1 ratio means EV drivers there pay six times less to fill up their car – the equivalent of $0.28 per liter. That’s because 2 kWh costs $0.28 while a liter of gasoline costs around $1.80. Even with a federal gas tax holiday, gasoline-burning drivers would still pay five times more to fill up than EV drivers. So, if the goal of conservative politicians is to make driving more affordable for Canadians, shouldn’t they do everything they can to get Canadians into EVs?

EMISSIONS — In Vancouver, electricity generation emits around 0.01 kgCO2 per kWh. The 2-to-1 ratio means driving on electricity there is 100 times less climate polluting than burning gasoline. That’s because 2 kWh emits 0.02 kgCO2 while one liter of gasoline emits 2.356 kg CO2. So, again, if the goal of conservative politicians is to help Canadians get around with minimal damage to our kids’ climate future, then why aren’t they pulling out the stops to encourage Canadians to dump their gas guzzlers?

As it is, Canadians are well behind the global average in switching to all-electric cars and trucks.

How to calculate effective carbon pricing

To quickly estimate the effective carbon price imposed by gasoline taxes, multiply the tax-per-liter by 400. For example, a gas tax of $1 per liter adds up to $400 per tonne of CO2 emitted.

The math: burning one liter of gasoline emits 2.356 kg CO2 — burning 424 liters emits 1,000 kg CO2 (one tonne). So, the tax paid on 424 liters equals the tax paid per tonne of CO2 emitted out of the tailpipe.

For Americans, multiply tax-per-gallon by 100 (or more precisely by 112).

Comments

Saxifrage: "What I don’t hear them talk about are the kind of cars and trucks that actually deliver these things to Canadians today — battery electric vehicles (BEVs)."

The real solution to our transportation needs, pollution, over-consumption, resource scarcity, biodiversity loss, energy extravagance, sedentary lifestyles and associated health costs, social isolation, and the climate crisis is not electric cars, but public transit, cycling, and walking in cities designed for people, not cars.

EVs solve only one of those problems, and only partially at that. No solution to the climate crisis is more shallow.

EVs still have a huge environmental and energy footprint. EVs continue to drive urban sprawl and put real solutions like efficient public transit out of reach.

Cars will never be green or sustainable. Cities clogged with millions of EVs will still be a transportation and ecological nightmare.

Let's invest in the real solutions, not the problem.

What is your timeline for rebuilding the car dependent suburbs into walkable, transit rich communities?

How many times have you directly lobbied all 10 provincial governments (who under the Constitution have control over cities) to impose density and mixed use zoning on municipalities? To increase funding for transit by orders of magnitude?

How many years experience do you have working with or inside urban planning departments? How many planning reports or urban design plans have you written? What can you tell us about the challenges professional planners and design consultants face to achieving climate success from a municipal perspective?

How does transit benefit commercial vehicles delivering food and other goods and tools and materials used by smaller contractors like plumbers, electricians, drywallers or major construction companies? Commercial vehicles comprise about 1/3 of traffic volumes and 99.9% of them currently run on petrol. Do you intend to reccommend actual solutions for them, or to continue to criticize using only generalizations?

Batteries are evolving quickly for both trucks and the power grid, meaning anti-EV policy will not address emissions from commercial vehicles or the grid in provinces that still burn coal and gas. What is your climate solution for millions of commercial vehicles providing vital services if they can never switch to electricity?

Planners and politicians do not have magic wands that instsntly convert cities into a walkable nirvanna experience where goods, services and commuters are tele-transported. There is no way to avoid the hard, decades-long slog it takes to urbanize and electrify cities when opponents are backed by powerful forces and when armchair critics have no clue about the actual detailed tasks required to accomplish their impossible goals.

Like the shift away from fossil fuels, the shift to public transit in sustainable communities will occur on the schedule of our own choosing. We decide. Sooner or later.

Or, if EVs take us on a permanent detour away from sustainability, never.

Switching from ICE cars to EVs only prolongs car culture. Cars, including EVs, drive sprawl.

Sprawl is difficult to undo. Doubling down on cars (EVs) and sprawl makes already difficult problems intractable.

Promoting EVs in super-sprawled cities puts "walkable, transit rich communities" out of reach. Making an extreme challenge impossible.

The only sustainable solution is public transit, cycling, and walking in sustainable communities. The sooner we build sustainable communities and shift to public transit, the better. The sooner we make the shift, the less sprawl we need to undo. Delaying the shift postpones sustainable solutions forever.

The decisions we make now about urban design set the blueprint for generations to come. We cannot undo sprawl except at enormous cost. So let's not make it worse!

EV promoters just kick the can down the road for future generations to deal with.

2) Public dollars are not infinite. Public dollars expended on EVs and EV infrastructure (charging stations, roads, freeways, bridges, parking lots, etc.) are public dollars not spent on urban redesign, public transit, cycling infrastructure, and sidewalks,

Zero-sum game. We have a choice: the public good — or private benefits for the few, while perpetuating the same ills that car culture has inflicted on society for decades.

Generational car dependency is hard to kick. Once people are used to driving everywhere they go, that behavior becomes next to impossible to change. Which makes it even more important to start the switch ASAP, before future generations are trained to be dependent on cars.

Once consumers with political power — middle- and upper class voters — are happily ensconced in their automobiles, there is no shifting them. There is no incentive for governments to invest in and improve transit if the vast majority vote for cars and EV subsidies.

The transit revolution is already a huge challenge now. When will it become easier? If it is difficult to pry people out of their cars today, what would make it easier decades from now? Why delay? If not now, when?

Decades down the road, why would car drivers living in super-sprawled cities switch to transit? What makes decades down the road a better opportunity for transit than now? Makes no sense.

There is no better time to make the shift to sustainable transportation options in sustainable communities than now. Why wait? Why make the problem worse?

All these metrics are going in the wrong direction:

-Sprawl and car dependency are increasing.

-Increasing loss of farmland and habitat around cities.

-More cars and more vehicles on the road.

-People buying larger and heavier vehicles (SUVs and pickups).

-More single-passenger traffic.

-Fewer commuters taking transit.

-The number of commuters facing long commutes.

-Transit users facing longer commutes than car drivers.

-Increasing crime, violence, and general safety concerns on transit systems.

-Spiralling fares and decreasing service.

When would these trends ever reverse?

Never, if EV promoters realize their nightmare vision of cities clogged with electric cars.

3) Environmentalists and sustainable urban designers were raising the alarm about cars, car culture, sprawl, and the decline of public transit long before climate became an issue. Few urban thinkers prescribe more cars.

"Shifting to EVs is not enough. The deeper problem is our car dependence" (CBC, Jul 31, 2022)

https://www.cbc.ca/news/opinion/opinion-electric-vehicles-car-dependenc…

"Rush to electric vehicles may be an expensive mistake, say climate strategists" (CBC, Dec 12, 2022)

"With their futuristic designs and new technology, EVs are the seductive consumer-friendly face of the energy transition.…For people with money and a conscience, EVs are doubly satisfying. They allow the affluent to indulge in the time-honoured pleasures of conspicuous consumption while at the same time saving the planet."

Urban planning advocate Jason Slaughter: "EVs are here to save the car industry, not the planet. Electric cars are still a horrendously inefficient way to move people around, especially in crowded cities."

https://www.cbc.ca/news/business/ev-transition-column-don-pittis-1.6667…

Prof Greg Marsden (Institute for Transport Studies at Leeds University): "Electrification is necessary but not enough.

"Travel demand reductions of at least 20% are required, along with a major shift away from the car if we are to meet our climate goals.

"This implies a really major social change. That is why it is a climate emergency and not a climate inconvenience."

"Electric car emissions myth 'busted'" (BBC, 2020)

https://www.bbc.com/news/science-environment-51977625

Check out podcast interviews featuring these Canadian authors:

James Wilt: Do Androids Dream of Electric Cars? Public Transit in the Age of Google, Uber, and Elon Musk (2020)

Paris Marx: Road to Nowhere: What Silicon Valley Gets Wrong about the Future of Transportation (2022)

"Are Electric Cars the Solution?" (The Tyee, 25-Jan-22)

https://thetyee.ca/Analysis/2022/01/25/Are-Electric-Cars-Solution/

4) Certainly, commercial vehicles can be electrified. A shift already underway. Not an argument for car dependency for personal transportation.

Personal automobiles are not required for battery R&D. Cars are not a necessary condition for advancement in battery technology. Batteries have all sorts of applications. Including buses and trucks.

Battery technology for small mobile vehicles, where weight, space, and range are key considerations, is not the same as for large-scale grid storage. Their evolution will follow different paths.

"Lithium-ion batteries aren't ideal for stationary storage, even though they're commonly used for it today. While batteries for EVs are getting smaller, lighter, and faster, the primary goal for stationary storage is to cut costs. Size and weight don't matter as much for grid storage, which means different chemistries will likely win out."

MIT: "What's next for batteries" (2023)

https://www.technologyreview.com/2023/01/04/1066141/whats-next-for-batt…

"RMI analysts expect lithium-ion to remain the dominant battery technology through 2023, steadily improving in performance, but then they anticipate a suite of advanced battery technologies coming online to cater to specific uses:

"Heavier transport will use solid-state batteries such as rechargeable zinc alkaline, Li-metal, and Li-sulfur. The electric grid will adopt low-cost and long-duration batteries such as zinc-based, flow, and high-temperature batteries." [And when EVs become ubiquitous—raising the demand for fast charging—high-power batteries will proliferate."]

"Huge Battery Investments Drop Energy-Storage Costs Faster Than Expected, Threatening Natural Gas" (Forbes, Oct 29, 2019)

https://www.forbes.com/sites/jeffmcmahon/2019/10/29/huge-battery-invest…

My timeline for sustainable transportation options in sustainable communities is shorter than your timeline that takes us on a never-ending EV detour.

Sustainability goals will be difficult to achieve. The EV route is what makes sustainability goals "impossible".

Transitions start by moving in the direction you wish to travel.

The EV option is like building new pipelines. Doubling down on fossil fuels takes us in the wrong direction. Building fossil-fuel infrastructure locks us into a fossil-fuel future. Likewise, doubling down on cars takes us in the wrong direction. Building automobile infrastructure and sprawl locks us into an automobile future.

When you're in a hole, stop digging.

I have never promoted a "never ending EV detour." Once again you are putting words into mouths of others that were never spoken.

I've lost count of the times I've promoted walkable, transit-rich communities over the decades. I have promoted EVs only to immediately replace petrol, with transit and land use planning following because they take decades to implement / enact, and once so, they will naturally subsume car dependency. I've lived in walkable neighbourhoods for 45 years and know what I'm talking about.

On grid batteries, L-ion was very quick off the mark to provide the large scale storage that only hydro could provide previously. I've also commented extensively on battery tech evolution, which apparently is so phenomenal and fast that too many observers missed it, including you. LMNC >>> LFP >>> NA (hybrid) >>> Si (hybrid), and transportation

<<< >>> grid, all in a matter of five years.

Non transport grid batteries are another successful story. Flow, liquid metal and iron-air are very promising. Batteries that evolved from EVs are complementary and most are minimizing their lithium content after first dumping nickel and cobalt. If you continue to cite L-ion then you are outdated.

As transit and zoning catch up, EVs will be parked then sold off in increasing quantities, bringing down the car population. At least that is the goal of most of the planners I've known for years. Their struggle is huge, and clearly you don't grasp that. It took Vancouver 35 years of transit, biking, walking and densification to achieve just 53% non car mode share (pre pandemic).

If suburbia undergoes the necessary transition to sustainable urbanism -- that's a big IF -- then the EVs that are left over could act as a massive, decentralized grid battery storage network when net metering is active. This affords savings for both consumers and utilities.

My goal is to promote climate action in all forms, especially in urban and intercity networks. and economies. A lesser goal is to counter the virtue signaling of some critics who issue impossibly pure principles and who practice guilt tripping, and inject some down to Earth practicality into the conversation.

Still waiting for Mr. Botta to explain how and when society would shift from cars to public transit — or how we would build sustainable communities — out of super-sprawled cities dependent on cars. How would that evolution come about?

Once again, Mr. Botta fails to grasp the fundamental problem: Cars enable sprawl, and sprawl forces people to drive. That is how our current urban nightmare came about.

Your prescription is more cars and more sprawl. Making the problem worse, not better. Making efficient transit impossible. Putting the solutions out of reach. Forever.

Botta: "Once again you are putting words into mouths of others that were never spoken."

How about this for a straw-man argument? "Planners and politicians do not have magic wands that instsntly convert cities into a walkable nirvanna experience where goods, services and commuters are tele-transported."

Where did you come up with that?

Botta: "I have promoted EVs only to immediately replace petrol, with transit and land use planning following because they take decades to implement / enact, and once so, they will naturally subsume car dependency."

Speaking of magic wands…

There is no natural progression from super-sprawled cities clogged by cars to walkable, transit-rich communities. A non-explanation.

Botta: "As transit and zoning catch up, EVs will be parked then sold off in increasing quantities, bringing down the car population."

A nebulous notion you quickly back-pedal on:

Botta: "If suburbia undergoes the necessary transition to sustainable urbanism -- that's a big IF"

Feel free to explain the mechanism by which that future would happen.

More magical thinking. Who is peddling fantasies?

Elsewhere on this page, Mr. Botta wrote:

"EVs will have an immediate impact on oil demand, but they should be seen as only a partial replacement until transit and polyzoning work their magic in a couple or three decades."

Work their magic?

By what magic does super-sprawl metastasize into transit-efficient cities?

Magical thinking is the substitute for an actual, logical, realistic plan.

Sustainable communities and public transit do not come about or work by magic. They require intelligent planning and massive investment over decades. Yes, decades. The sooner we apply ourselves to that project with all available resources — time, money, labor, planning and design — the better.

Doubling down on cars and sprawl — and diverting scarce public funds to EV subsidies largely to affluent consumers who do not need them — is deliberate sabotage.

If time is your concern, no, we do not have time for your EV detour.

More people than ever are commuting by car in Canada's big cities, including Toronto and Vancouver.

Sprawl continues to plague Canadian cities from coast to coast.

Data speaks louder than empty goals, non-plans, and idle prophecies.

Botta: "[walkable, transit-rich communities] take decades to implement / enact"

Not a reason for delay.

Not a reason for going down the wrong road in our EV.

The energy shift itself will take decades to implement. That is why it is called a transition. Not a reason for delay.

Following your logic to advocate for EVs, the fossil fuel industry responds to the climate crisis by doubling down on the problem. Buying and building oilsands pipelines to fund climate action is hopeless environmental policy. Subsidizing and promoting EVs is hopeless transportation policy.

All transitions start by moving in the direction you need to go.

The longer we delay, the greater the challenge. It's like delaying cancer treatment or a dental filling. No benefit — just more damage and more cost.

These analogies are apt because sprawl is like a cancer. Like dental decay, it also eats away at farmland and habitat. The damage is terminal. Virtually irreversible.

How to end global car dependency? Probably not by adding millions or billions more cars to the road. A never-ending nightmare. But such is the dream of EV promoters, car companies, neoliberal governments, and misguided activists.

EVs and fast, efficient, affordable mass transit are not complementary options. They are mutually exclusive.

Choose one or the other.

Why invest in the problem, not the solution?

Is the decades-long transformation a reason for delay? The sooner that transformation occurs, the better, surely?

How does the urban transformation occur except by making it happen? The design, the investments, the political leadership, the cultural shift — all need to be happening now.

"impossibly pure principles"

Simply being realistic. Either we learn to live sustainably on planet Earth or not at all.

What is impossible is living far beyond the limits of Earth's carrying capacity.

What is impossible is solving a problem by making it even worse.

Doubling down on cars in super-sprawled cities makes the monumental challenge of efficient transit in sustainable cities impossible.

To tell the truth, I have no confidence at all that humanity will succeed in the experiment we call civilization. But if we are to achieve efficient public transit in sustainable cities, a revolution is what it would take.

That said, it was a revolution that brought us to this brink. We need another revolution to transcend the chasm.

All indicators suggest ecological collapse, rapid global warming, climate disruption, millennia of sea level rise, habitat destruction, biodiversity loss, and resource exhaustion.

Most likely we shall continue to blunder on down our dead-end road in our EVs, blissfully unaware of the casualties.

Last person standing, turn out the lights.

Q) Why are more progressive cities introducing traffic calming, congestion pricing, pedestrian zones, densification, rezoning, etc.?

A) Because cars and sprawl are wildly unsustainable. Cars and sprawl make cities unworkable and uneconomic; harm public health, and destroy community. Massive invisible subsidies cost us billions.

Adding more cars to the mix only exacerbates the problem.

EV subsidies vs free transit passes.

A $5000 EV subsidy per household (typically one or two people) or 50 free transit passes?

Two hundred EV subsidies ($5000) for 200 affluent households who do not require subsidies while non-drivers, the marginalized, the young, the old, the disabled wait for a bus that never comes? Or 20,000 free transit passes? Or a brand-new electric bus with room for 60 passengers?

For $1 million in public funds, we can shift 60 ICE car drivers at a time onto a new electric bus that runs all day — or subsidize 200 EVs that cost $40,000-$75,000 a pop (plus infrastructure costs) that spend most of their life parked.

Aggregated, $5000 EV subsidies per household can move many more people on transit. We can move far more people on transit for less cost. Fiscal efficiency matters.

EV subsidies are an extremely expensive and inefficient way to reduce emissions. Terrible public policy. Though it's easy to see why the affluent, the entitled, and the powerful prefer them.

How do you plan on “walking” “cycling”, or using public transport to move all the necessary goods, like food and other necessities from our ports of entry to the parts of the country they need to go to?

As previously noted, commercial vehicles can be electrified. Heavy trucks can use hydrogen fuel-cells. That shift is underway.

Not an argument for dependency on cars for personal transportation when sustainable options are available.

Hydrogen is far from ready. Electricity is already here and is wudely distributed. And you will never achieve commercial vehicle electrification without batteries.

In other words, EVs will always be with us in one form or another.

Thx, nice to fact based evidence instead of Conservative Bbb Ssss

Excellent analysis as usual, Barry.

So, first, it's very clear Canada doesn't pay much tax on gasoline.

But that last chart showing CO2 from transport per capita alongside gasoline tax levels . . . until you get to the few outliers at the bottom end, mostly us and Australia and the US, the CO2 part seems really flat--there doesn't seem to be much relationship between the two except when you get to extremely low tax levels, with those low-tax countries being a very small sample. Makes me wonder if other factors are more important--like, availability of transit, bicycle use (certainly in the case of Holland), whether urban areas are walkable, in the case of Norway all the incentives that have driven massive EV uptake, even levels of advertising for big vehicles. The US and Canada are both I think poor outliers in a lot of those areas as well.

Perhaps car dependency is not just a matter of the absence of transport alternatives, like transit and bikes. If it was, then merely adding the cheapest forms of the alternates would work well.

But Autotopia here is too deeply ingrained into the structure of our cities to consider that it can be quickly corrected by adding a few surface ribbons of LRT, instant bike lanes and scattered EV charging stations.

Sustainable urbanism requires a binding marraige of zoning, urban design specifically for walking humans, and a true transit orientation and focus at the urban core. It may be best to ignore road networks altogether until walkable communities and frequent transit networks are planned for first and foremost when it comes to redesigning the suburbs.

Meanwhile, EVs will have an immediate impact on oil demand, but they should be seen as only a partial replacement until transit and polyzoning work their magic in a couple or three decades.

Note that Norway's oil revenue may be subsidizing EVs, but not their national budgets which are underpinned by high taxes. This has led to building one of the largest sovereign wealth funds in the world mainly by banking the revenue, one ironically based on Alberta's original Heritage Fund. Obviously Norway has managed its oil resource far better than Alberta, but now both are under increasing climate pressure, with Norway better positioned to fund its transition.

A few caveats

First, geographically, we have a natural impediment NOT faced by most countries. As is so often noted, the vast majority of Canadians live within a narrow band close to our southern border. And we are the second largest (by area) country in the world. Even living huddled along the southern border, we are still scattered enough that a transportation system that covers most of the country is a necessity. Compare THAT to the United Kingdom. That does not excuse all the townies who choose to drive trucks, even if they call them "utility" vehicles. Nor does it excuse vehicle manufacturers opting to skirt regulations on the fuel efficiency of "passenger" vehicles by modifying truck chassis to become attractive to people with families.

Next, is the devil's choice we were forced to swallow when Brian Mulroney negotiated the first Free Trade agreement with the U.S. (Actually a oligopolist's dream of a corporate friendly sell out of Canadian interests) During the talks, the U.S. negotiators pointed out that Canadian oil and gas reserves outstripped those of their country (this was pre-fracking development). Canadians were faced with a double edged option:

1) Either keep paying for oil, and the gasoline refined from it, based on the cost of production, and accept countervailing duties to reflect the disparity. (Think softwood lumber, writ large)

Or

2) Pay WORLD prices (based on the price of West Texas Intermediate) and there would be no running debate about so called subsidies to ALL our industries.

As a result, the multinational conglomerates operating most of the Canadian oil industry are laughing all the way to the bank as they pocket the difference while the rest of us pay through the nose.

Finally, there is the glaringly obvious fault in the logic, if you can call it that, presented by Pierre "Skippy" Poilievre. What instrument would the government have to police whether or not the taxes foregone in this "tax vacation" would be passed along to consumers? In my imagination, I can see them all trumpeting how they are cutting prices to reflect the lifting of those charges. Then quietly jacking the price at the pump back up as they are forced to double the fleet of armoured trucks delivering the price gouged profits to their coffers.

Oh, let's not forget the lost revenue to the various treasury boards that have calculated the budgets to include this income.

Surface electrified intercity rail, urban rapid transit and local rail transit are all possble and affordable in a wealthy society like ours. Even high speed rail is do-able between city pairs. Toronto-Montreal should have had HSR long ago. Expand the corridor to Windsor-Detroit, Hamilton-Buffalo and Quebec City and you've got a population base similar to London-Paris. Calgary-Edmonton is a no brainer. Building rail on the Prairies is topographically easy, especially the quick intercity level service below HSR.

There is no excuse for not starting to plan for electric rail in Canada in all its varied permutations.

"The real solution to our transportation needs, pollution, over-consumption, resource scarcity, biodiversity loss, energy extravagance, sedentary lifestyles and associated health costs, social isolation, and the climate crisis is not electric cars, but public transit, cycling, and walking in cities designed for people, not cars."

True that, had we started down this path say (arbitrarily) 30-40 years ago. Now we will suffer and attempt to endure while opposing the insanity where we can.

Thanks Barry for this thought provoking analysis. Special thanks to G. Pounder for your time-consuming (researching and providing links etc) and detailed efforts to inform "the rest of us". i wish i were more hopeful for the future......but i really only feel deep sadness for all that will be lost.

While it is important to appreciate how much carbon pricing in Canada is below that in European countries, is that the main reason our GHG gas emissions from from the transportation sector are so much higher than theirs? Greater population density, accessible public transit, and regulatory and infrastructure support of EVs and active transport play a greater role in the emissions differential than carbon pricing.