Support strong Canadian climate journalism for 2025

Back in 2015, the founder of Bloomberg New Energy Finance, Michael Liebreich, penned his annual predictions for what would unfold in the energy world. To set the scene, he took the reader back 60-odd million years ago to when both dinosaurs and mammals wandered the earth.

The mammals were industrious, quick, clever and adaptable, and were multiplying—but hardly noticed by the enormous dinosaurs, who were principally concerned with battling each other for dominance. The different dinosaurs represented incumbent fossil fuels while the mammals represented emergent clean energy technologies.

While clean energy progress was gaining momentum in 2015, Liebreich lamented that these “mammal stories” got little attention. Media and the public were fixated on “dinosaur stories.”

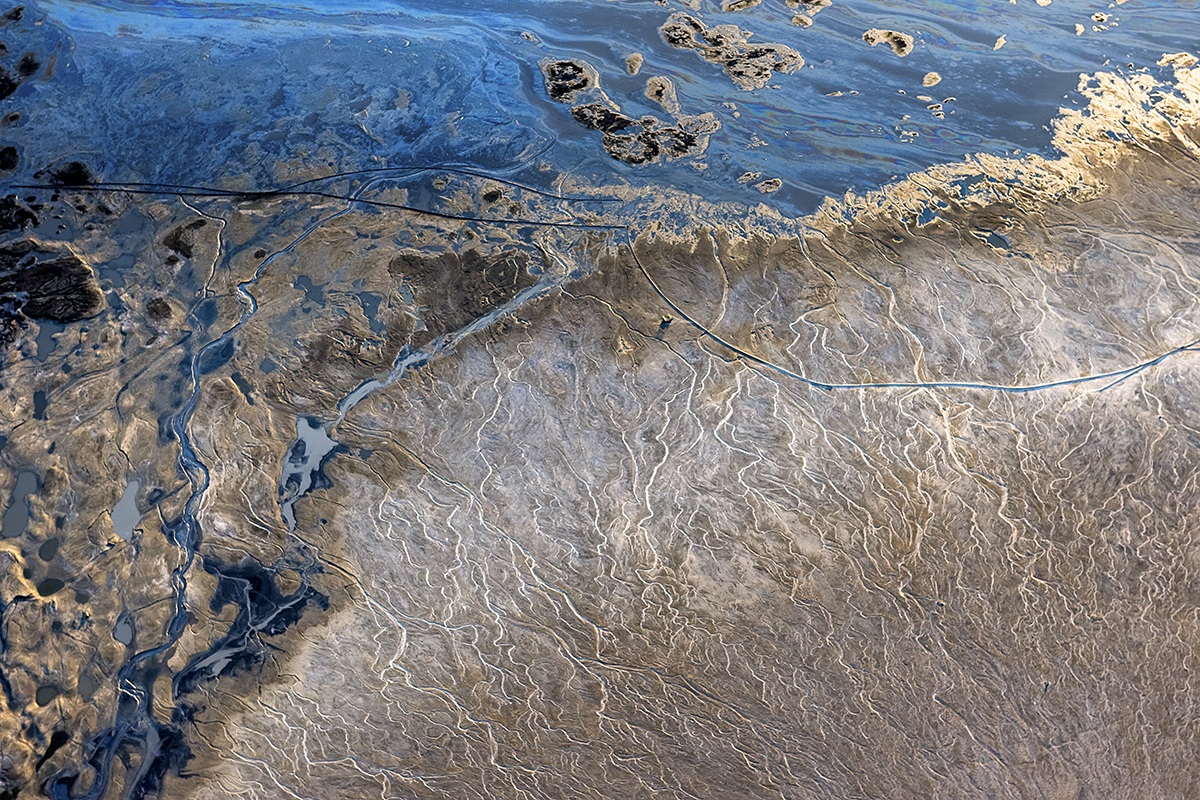

Canada’s energy conversation today is no different. The headlines dedicated to Teck Resources’ proposed Frontier oilsands mine prove “dinosaur stories” still rule the day. Yet ironically it’s the “mammal stories” that offer Teck the ability to evolve and benefit from the transition to clean energy.

For Teck Resources, its foray into the oilsands clearly hasn’t gone as planned. Frontier will almost certainly not be built, even if approved. And the company just suffered a significant write-down on its only producing oilsands project. But Teck has other more promising long-term opportunities that support, rather than resist, the energy transition. As a major producer of copper and metallurgical coal, it stands to benefit from the growing demand for these materials from electric cars and batteries, solar panels and wind turbines.

As the International Energy Agency noted in a recent report, “no oil and gas company will be unaffected by clean energy transitions, so every part of the industry needs to consider how to respond.” Just as some dinosaurs survived—today’s birds are their descendants—some oil companies are pivoting into clean energy. Companies like Shell, BP and Equinor are diversifying into energy companies, investing in solar and wind, batteries, hydrogen and electric vehicle charging. It’s also notable that each has withdrawn from Canada’s oilsands.

Alberta is home to a growing number of entrepreneurs focused on finding opportunity in the energy transition—mammals scurrying amongst the dinosaurs. Companies like E3 Metals and Summit Nanotech, which produce lithium destined for electric car batteries from oilfield wastewater. Or Proton Technologies, a start-up developing technology that produces hydrogen from oil (leaving the carbon underground). And then there are more established companies that are scaling up like Greengate Power, which recently landed half a billion dollars of foreign investment to build Canada’s largest solar farm.

The Frontier oilsands mine is, for the moment, a symbol of hope for Albertans praying for one more boom. But it’s a false hope.There’s a consensus amongst energy analysts that in a world taking climate change seriously, a peak, plateau and decline in the demand for oil is inevitable as electric cars take hold and the world shifts away from profligate use of plastics.

It doesn’t really matter whether Prime Minister Trudeau and his Cabinet reject the Frontier Mine because it’s too dirty and damaging, or approves it subject to rigorous conditions requiring it to produce the cleanest, lowest impact barrels of oil in the world. If we’re honest, either decision marks the end of the project.

But it doesn’t have to mark the demise of hope for Alberta, its oilpatch and its workers.

The Prime Minister has extended an olive branch to Albertans: a pipeline to access new markets and secure higher prices for current oil production, a responsible transition for affected oil workers, and support for clean energy innovation and infrastructure.

The Frontier Mine decision is symbolic, but not in the way most pundits suggest. It’s symbolic of a much bigger choice thrust upon the oil patch, Alberta and Canada alike:

Are we mammals and birds, or are we dinosaurs?

Comments

This "Teck" article is an interesting analogy, but there are several parts of it that aren't sufficiently explored.

The fact is that the fossil fuel dinosaurs are still exercising undue influence over the "mammals" from beyond their tar pit graves. Peak Oil has produced existential threats to the mamalian era and the pitiful surviving canaries descended from the dinosaurs are disappearing from earth at a terrifying rate - along with the insects, the microbiological life forms that underpin the entire chain of life on earth.

Fossil fuel and its overwhelming, unrelenting undegradable toxic petro-chemical bootprint is crushing biological life. That ultimately includes us. So it is not JUST climate change that fossil fuel is unleashing, but the petrochemical avalanch is extinguishing billions of years of evolution.

Exactly....and we have to keep saying it, keep referencing the peer reviewed science that tells us how bad it actually is, and start rolling in the aisles with laughter and despair, when companies like the one behind Teck start talking none sense about mining 'tar' while producing 0 emissions. There is no way on this green earth anyone can do that........fossil fuel is used throughout the entire process, and of course the product being extracted is itself a greenhouse gas emitter, once used.

These current dinosaurs talk gibberish, euphemism and outright falsehoods. Why do so many of us still let them do it?????

Sorry, when did the world start to "shift away from the profligate use of plastics"? Any evidence of that at all?

“The Prime Minister has extended an olive branch to Albertans: a pipeline to access new markets and secure higher prices for current oil production, ...”. If it is the Trans Mountain pipeline being referred to here this is thoroughly misleading. The existing pipeline goes to tidewater at the Westridge Marine Terminal in Burnaby; this allows access to markets anywhere in the world, but is being used far below capacity. In 2019 only 12 tankers loaded here whereas the capacity is over 100 for large tankers and over 200 for small tankers.

The evidence shows that a “higher price” in Asia is a myth. If it were true, all the tankers would go to Asia whereas most of them actually go to California. From 2014 to 2019 of 206 tankers loaded, only 21 went to China, half of them in late 2018 when the price of Western Canada Select was as low as one quarter of normal. When the Alberta Premier ordered production curtailed the price shot up to normal and tanker shipments to China stopped. (Details are in my report at https://tinyurl.com/wzj7vv4)

Thank you David Huntley for doing all of this research and analysis and for making it generally available. I can’t understand the motivation for all of the deception. I don’t suppose you can shed any light on that?